You’re MATCH-Listed, Now What?

Oct 18, 2019

Member Alert To Control High-Risk (MATCH) Merchants: the six-word phrase that every merchant dreads seeing.

If you’re just getting off the MATCH list, you, like many of our merchants, know firsthand the difficulties it causes. And, will continue to create if you don’t know what approach to take now that you’re off the list or how to manage removing yourself from the list, if possible.

We know you never want to end up back there. Let’s face it, five years is a very long time. But if you’ve never been on the list, it’s important to understand what may get you on it and how it can hurt your business. Here’s a quick synopsis.

What is MATCH, and what does it mean for your business?

MATCH may mean and almost seem like five long years in the wilderness. But it is a credit risk review system used by acquiring banks and payment providers that offer credit card processing. They check your company creditworthiness before issuing you with a merchant account.

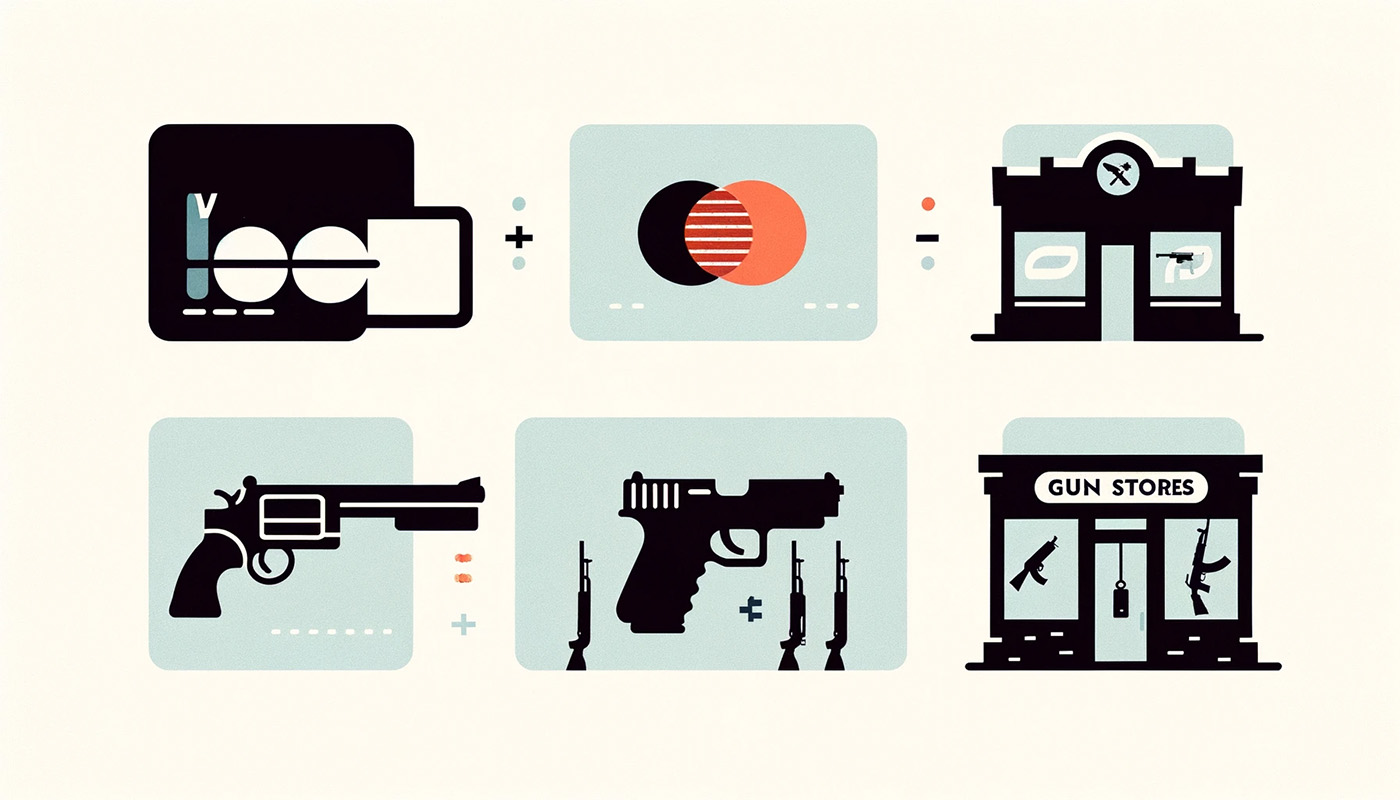

It’s like getting a credit check when you go to the bank to get a loan – they’re getting into your financial history. On the list are companies, domain names and their owners who have breached the terms of the Visa or MasterCard Service Agreement.

An acquiring bank may put a merchant on MATCH list if their account has violated regulations set forth by Visa or MasterCard. This results in the company being blacklisted and makes it almost impossible to get a new merchant account.

Your company information can remain on the list for up to a maximum of five (5) years – although depending on the violation, there could be a lifetime ban. Termination and being on the MATCH list are not mutually exclusive. A terminated account can occur without the service provider blacklisting your company.

So, MATCH vs. TMF?

People use MATCH and the Terminated Merchant File (TMF) interchangeably. Both databases are accessible to acquiring banks to identify if your company is high risk.

You won’t realize that you are blacklisted until you apply for a new merchant account and can’t get approval. Once you get blacklisted, that’s it. Or, is it?

How did you get there?

One of our popular posts – Help, I’m On The Match List – goes into more detail about the TMF/MATCH list. So, want to know some of the reasons you could be on the MATCH-list? Or get some ideas about what you can do that’s not covered in this post? Then take a read, get some more information, come back and finish up on all the other things you need to do next.

But, one of the main reasons a company is placed on the list is a high chargeback ratio.

That’s why it’s important to be careful when you choose your merchant service provider. Because, if you’re like the many “high-risk” businesses out there using low-risk services from Stripe, PayPal, Wells Fargo or Chase, then you’ll eventually have problems.

These low-risk processors do not tolerate chargebacks. They will penalize your company even for one month of bad performance and are quick to shut down and place on MATCH or TMF with little reasoning.

Want to see how easy it is for this to happen?

Imagine that a high-end consumer electronics vendor did $500K in sales last month. Let’s say they had a total of 500 transactions for an average of $1000 per order. Now, imagine they experienced an issue with order fulfillment. This could be because their supplier was late in delivering the orders. Or, there is an issue with the product quality, and several have defects on arrival.

Whatever the case, imagine if it resulted in 15 chargebacks totaling $15K. Now, only 15 of the 500 orders were returned. So, it’s only $15k of a $500K month. The chargeback ratio for the volume and the total transactions individually would be 3%.

Not a terrible month of business, because the merchant was able to determine the issue and fix the problem for the upcoming months.

But, the margin of error for low-risk merchant processors is very small. And this is especially important given the lowered Visa threshold for fraud-to-sale and dispute-to-transaction (chargebacks) ratios. They’ve risk level has fallen from 1% to 0.9%. Plus, it’s important to note that the ratio is even lower for the acquiring banks, so they have to be careful.

This also means these traditionally low-risk processors may be even more conservative. So, it can be easy to get placed on this list if your risk creeps up inadvertently. Its also hard to speak to someone or explain your situation when things don’t go as planned or you had an unexpected issue in your fulfillment or with product quality.

Is your full name and company details finally off MATCH list? Are you ready to apply for a new merchant processor? Then get in touch. It pays to have an advocate on your side to navigate getting a merchant account again. But, if that’s not the case just yet, read further to see what you can do now that you’re off the list.

How to get off the MATCH list

That can be a difficult task. The first step is to determine how you got on there in the first place, why and which provider placed you there.

Contact the risk department of your previous payment providers to find out which one placed you on the list. We know this sucks! It’s like the pain you feel calling up a bad ex to ask a favor.

Your next step is to find out why you were put on the MATCH list. If it’s possible, start to negotiate to get off.

In your negotiations, you can highlight things like fulfillment company errors that spiked chargebacks. Or, a public announcement about recall of a defective product, which proves you weren’t malicious. Or, there was a compliance issue, which you’ve now fixed. Once you have some evidence in writing, you could potentially get it solved and be off the list sooner than five years.

So, you’re off the MATCH list. Now what?

The big question: what to do next?

Here are a few tips to help.

1. Choose your merchant processing wisely

We cannot emphasize this enough! The merchant account provider you choose for processing can make or break your business. This is crucial if you operate in a vertical labeled high-risk by the various credit card companies.

Avoid low-risk processors (like Stripe and PayPal) if you’re selling high-end products where the chargeback rates may get high from time to time. Instead, opt for a dedicated merchant account from a processor that handles high-risk businesses without taking advantage of their clients, like DirectPayNet.

2. Get the right systems and tools in place

To set your business up for success when applying for a new account, put in place the necessary tools to prevent frauds and keep chargebacks low.

- Where there are credit card transactions, there’s the possibility of fraud. Implement and use anti-fraud tools. They’re a myriad of quality anti-fraud tools from which to choose.

- Get PCI compliant if you weren’t before.

- Hire a chargeback management service to make this process easier.

- Get an advocate to champion your cause in the new application process. Choose one with experience in working with high-risk businesses and have developed relationships with acquiring banks. A merchant processing advocate like DirectPayNet will review your situation, outline what you need to have or do and work with you through the application and approval process.