Shopify’s transaction fees are eating into your profits more than you realize. Let me break down why their fee structure creates significant challenges for growing businesses.

The Fee Trap

Shopify’s rigid fee structure creates a costly trap for growing businesses in 2025.

On the Basic plan, you’ll pay 2.9% + $0.30 for every online transaction and 2.7% for in-person sales. These rates stay fixed regardless of your sales volume, preventing you from leveraging your growth for better rates.

The trap becomes even more apparent when you try to use your own payment processor. Shopify charges an additional 2% fee on all transactions processed through third-party providers on the Basic plan. This penalty effectively forces merchants to use Shopify Payments, even when better alternatives exist.

Let’s break down the real impact:

Basic Plan Costs:

- Online domestic cards: 2.9% + $0.30

- International/Amex cards: 3.9% + $0.30

- In-person transactions: 2.7%

For a business processing $20,000 monthly in online sales, you’ll pay $580 in transaction fees alone. That’s money that could be reinvested in your business growth.

With a negotiated merchant account, these fees typically decrease as your volume increases – a benefit Shopify doesn’t offer.

The platform’s inflexible pricing model particularly hurts mid-sized businesses that process enough volume to qualify for better rates elsewhere but remain locked into Shopify’s fixed fee structure.

This rigidity forces merchants to either accept unnecessarily high costs or undertake the complex process of migrating to a different platform.

The Third-Party Payment Penalty

Shopify’s approach to third-party payment processors reveals their true colors in 2025. They slap you with a hefty 2% fee on every transaction when you dare to use your own payment processor.

This penalty jumps to 2.5% on their Starter plan and drops to only 0.5% on their expensive Advanced plan – but let’s be real, you’re still paying extra just to use your preferred payment method.

Think about what this means for your bottom line. If you process $50,000 monthly through a third-party processor, Shopify takes an extra $1,000 just because you didn’t use their system. That’s $12,000 annually in unnecessary fees – money that could fund your marketing budget or hire a part-time employee.

This penalty becomes particularly painful when Shopify Payments isn’t even available in your region or doesn’t support your business type.

Some high-risk businesses can’t use Shopify Payments at all, yet they’re still forced to pay this penalty. Even worse, if you’ve negotiated excellent rates with another processor, Shopify’s additional fee often wipes out any savings you might have secured.

The message is clear: Shopify doesn’t just want to be your e-commerce platform – they want to control your entire payment ecosystem. This monopolistic approach limits your business’s flexibility and forces you to pay more than necessary for payment processing.

In a world where every percentage point matters to your profit margin, these fees represent a significant and unnecessary drain on your resources.

The Real Numbers Behind Shopify’s Pricing

Let me break down exactly what you’ll pay when processing payments through Shopify in 2025. The costs stack up quickly when you combine all their usage and credit card fees.

Credit Card Processing Fees

- Online transactions: 2.9% + $0.30 per transaction

- In-person sales: 2.7% per transaction

- International/Amex cards: 3.9% + $0.30

Third-Party Payment Penalties

- Basic plan: 2% additional fee

- Standard plan: 1% additional fee

- Advanced plan: 0.6% additional fee

Let’s put this into perspective with real numbers. For a business processing $50,000 monthly in online sales:

Using Shopify Payments

- Processing fees: $1,450 (2.9%)

- Fixed fees: $150 ($0.30 × 500 transactions)

- Monthly total: $1,600

Using Another Processor on Shopify

- Processing fees: $1,450 (2.9%)

- Fixed fees: $150 ($0.30 × 500 transactions)

- Shopify penalty: $1,000 (2% additional)

- Monthly total: $2,600

This means you’re paying an extra $12,000 annually just for the privilege of using your preferred payment processor. These fees become even more significant as your business grows, since Shopify maintains these fixed rates regardless of your volume.

GET A BETTER RATE WITH DIRECTPAYNET

Why This Model Fails Most Businesses

Shopify’s rigid pricing structure creates significant limitations for growing businesses in 2025. Their inflexible model particularly impacts established merchants who process enough volume to qualify for better rates elsewhere.

Limited Flexibility

The platform’s approach to payment processing reveals major drawbacks. You’ll face fixed rates regardless of your sales volume, preventing you from leveraging growth for better terms.

Even worse, if Shopify Payments isn’t available in your region, you’re forced to pay additional fees without any alternative.

Hidden Costs

The expenses pile up quickly beyond the basic Shopify fees transaction. You’ll encounter:

- Currency conversion fees for international sales

- Additional costs for apps and plugins that quickly accumulate monthly

- Integration fees with other systems like PIM and ERP

Feature Bloat

Many businesses end up paying for features they’ll never use. The platform’s one-size-fits-all approach means you’re stuck with a complex system when you might only need basic e-commerce functionality.

Who Actually Benefits from Shopify

While Shopify markets itself as a universal solution, specific types of businesses gain the most value from their platform in 2025.

Also, if you’re asking, “does Shopify charge transaction fees,” then Shopify probably isn’t for you.

New Online Businesses

Shopify excels for entrepreneurs just starting their e-commerce journey. The platform’s user-friendly interface requires minimal technical expertise, allowing quick online store setup and management without coding knowledge.

The built-in security features and 24/7 customer support provide good safety nets for newcomers.

Growth-Stage Startups

Startups experiencing rapid growth find value in Shopify’s scalability. The platform handles increased traffic volumes efficiently, with business owners collectively generating over $543 billion in sales.

The extensive app ecosystem, featuring over 8,000 applications, enables startups to add functionality as they expand.

Region-Specific Merchants

Businesses in certain geographical areas can benefit from Shopify’s global reach across 175 countries.

The platform’s multi-currency support and international payment options make it particularly valuable for merchants targeting global markets or operating in regions with limited e-commerce infrastructure.

Mobile-First Retailers

With 79% of Shopify store traffic coming from mobile devices, businesses focusing on mobile commerce find particular success.

The ecommerce platform’s mobile-responsive themes and seamless checkout process cater perfectly to the growing mobile shopping trend.

Community-Focused Brands

Businesses emphasizing customer engagement and loyalty programs thrive on Shopify. Over 60% of Shopify stores now utilize loyalty programs, with 73% of customers actively engaging with rewards systems. This makes the platform especially suitable for brands focusing on community building and customer retention.

The Better Alternative

Let me show you why dedicated merchant accounts crush Shopify’s one-size-fits-all approach in 2025. As someone who’s helped hundreds of businesses optimize their payment processing, I’ve seen the dramatic impact of switching to dedicated solutions.

Negotiable Rates That Scale

Traditional merchant accounts offer something Shopify won’t – the power to negotiate. Your processing volume becomes your bargaining chip.

Process $100,000 monthly? You could secure rates as low as 1.8% + $0.20 per transaction. That’s significantly lower than Shopify’s fixed 2.9% + $0.30, potentially saving you thousands monthly.

Custom Solutions for Your Business

Working directly with payment processors gives you:

- Interchange-plus pricing that passes actual card network costs

- Volume-based rate reductions

- Specialized solutions for your industry

– Direct integration with your existing systems

Real Cost Savings Example

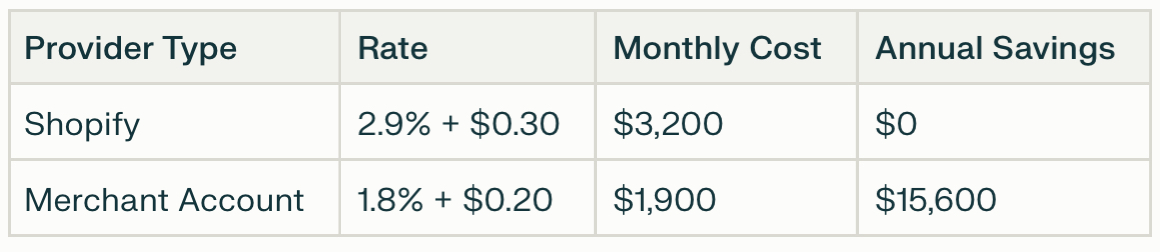

Let’s crunch the numbers for a business processing $100,000 monthly:

Enhanced Control

With a dedicated merchant account, you gain:

- Direct relationships with your processor

- Faster deposit times

- Better fraud protection tools

- Detailed transaction reporting

- Custom integration options

Future-Proof Processing

As your business grows, your merchant account grows with you. You’ll never outgrow your payment processor or feel trapped by platform limitations. Plus, you maintain the flexibility to switch processors without rebuilding your entire store – something Shopify makes nearly impossible.

Remember, while Shopify makes sense for some businesses, established merchants processing significant volume deserve better than one-size-fits-all pricing. Your payment processing should be as unique as your business model.