- Firearms

- Guns

- HIGH RISK MERCHANt

- HIGH RISK MERCHANT ACCOUNT

- MERCHANT ACCOUNTS

- Merchant Category Code

Lawmakers Call for Credit Card Companies to Decide on Firearm Merchant Category Code

Dec 13, 2023 2 minutes

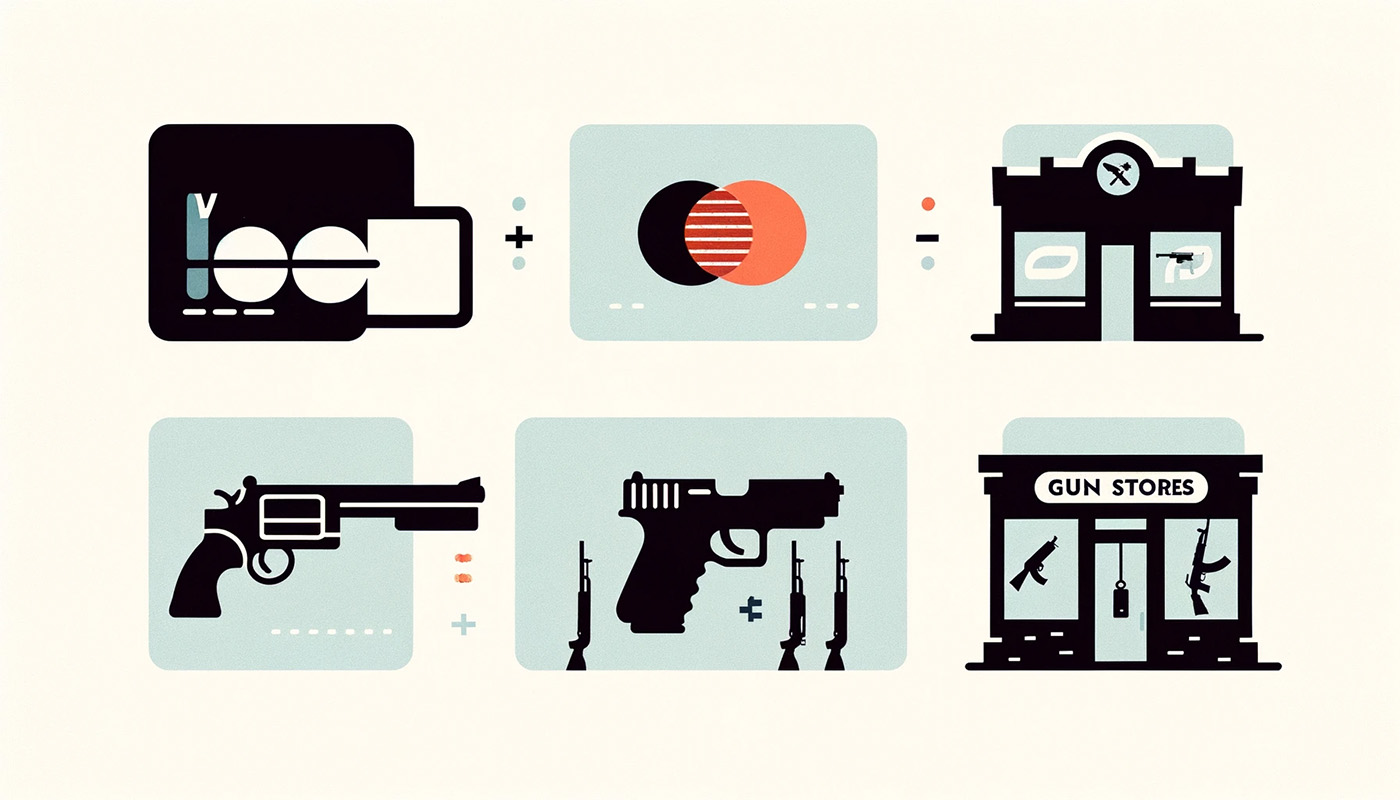

In recent months, the implementation of a new merchant category code (MCC) specifically for gun and firearm sales has sparked a complex debate among financial institutions, lawmakers, and the firearms industry in America.

This development, initiated by the International Organization for Standardization (ISO) in September 2022, is poised to bring significant changes to how credit card transactions are categorized in the firearms sector.

The decision has drawn attention from major credit card companies like Visa, Mastercard, American Express, and Discover Financial Services, each facing their own challenges in navigating the politically charged landscape that surrounds this issue.

The delay in the implementation of the gun MCC, largely due to varying state legislations and political pressures, underscores the complexity of integrating financial services with sensitive topics like gun control and gun rights.

Merchant categories and their legal background.

Background on Merchant Category Codes

Merchant Category Codes (MCCs) are essential tools in the financial services industry, serving as a cornerstone for organizing and identifying types of transactions. These four-digit codes, established by payment networks categorize businesses based on the goods or services they provide.

The importance of MCCs extends beyond simple categorization. They play a crucial role in everything from determining reward points to assessing risk levels for merchants.

The introduction of a specific MCC for gun and firearm sales represents a significant shift in how financial transactions in this sector are viewed and managed. This new category not only aims to provide more clarity and precision in financial reporting but also reflects the evolving landscape of retail, particularly in sensitive areas like gun sales.

In the context of the broader financial ecosystem, the integration of a dedicated MCC for gun sales underscores the dynamic nature of merchant categorization and its impact on various stakeholders, including credit card companies, retailers, and cardholders.

Implications differ per state.

Recent Developments

The journey of the new merchant category code (MCC) for gun and firearm sales has been marked by significant developments, particularly since its approval by the International Organization for Standardization (ISO) in September 2022. This specific MCC, designed to categorize transactions at gun and ammunition stores, has stirred a considerable debate across various sectors.

Following the ISO’s decision, major credit card companies responded by pausing the implementation of this new code. This pause is largely attributed to the complex legal and political environment surrounding gun control and gun sales in the United States.

Notably, the response from these credit card giants has been influenced by new state legislations. Some states, like Florida and Texas, have passed laws that block the use of this specific MCC, citing concerns over privacy and potential overreach in monitoring legal gun purchases.

On the other hand, states like California have gone in the opposite direction, requiring the use of this new MCC.

The implementation of the gun MCC has become a politically charged issue, with state attorneys general and lawmakers divided in their stance. While some Democrats are advocating for the swift implementation of the code, citing concerns over gun violence and the need for better tracking of gun sales, some Republican leaders are pushing back, arguing against what they perceive as unnecessary regulation and potential infringement on gun owners’ rights.

The current scenario reflects a landscape of uncertainty and debate, with credit card companies caught in the middle of a politically and legally complex situation.

Decisions on gun laws and merchants.

Congressional Involvement

The implementation of the new MCC for guns has not only been a topic of discussion at the state level but has also gained significant attention in the United States Congress. This heightened interest reflects the national significance of the issue, bridging the gap between financial regulation and gun control legislation.

Leading the charge for more information and action, Senator Elizabeth Warren, along with 48 other congressional Democrats, has been vocal in demanding answers from major credit card companies. The primary focus of their inquiry revolves around the delayed implementation of the new gun MCC and the reasons behind this postponement.

These lawmakers have posed critical questions to the CEOs of these card networks, seeking clarity on their progress in implementing the code, their stance on its necessity, and their plans to comply with state laws.

How firearm merchants can prepare.

Implications for Gun Merchants

First and foremost, the new merchant code could alter the way gun sales are tracked and reported. For gun merchants, this means adapting to a new categorization system that might affect transaction processing, suspicious activity reports, and possibly, compliance requirements.

It’s important for firearm retailers to understand these changes to ensure seamless integration with their existing financial systems and to maintain compliance with both federal and state regulations.

Another consideration is the potential impact on customer relationships and privacy concerns. Some gun owners may view the specific tracking of firearm purchases as an intrusion of privacy and infringing on their Second Amendment rights, which could influence their purchasing decisions. Gun merchants will need to navigate these customer concerns carefully, balancing transparency with respect for customer privacy.

Furthermore, the new MCC could have implications for financial relationships and services. Banks and credit card processors may adjust their policies regarding gun sales, affecting terms, fees, or even the willingness to provide services to gun stores.

Lastly, the political and social landscape surrounding gun control and gun rights could indirectly affect gun merchants. As public and legislative attitudes shift, the firearms industry may face additional scrutiny, regulatory changes, and evolving public perceptions, all of which could impact business operations and strategies.

What to think, what to do.

Future Outlook

As the debate and implementation of the new merchant category code for guns and firearms continue to evolve, the future outlook in this sector remains a topic of keen interest and speculation. The intersection of finance, retail, and societal issues like gun safety, gun trafficking, and gun rights suggests that the landscape will continue to be dynamic and potentially contentious.

One of the key aspects to watch is how credit card companies will navigate the balance between compliance and the broader implications of their decisions on gun sales and gun control. The responses from Visa, Mastercard, Amex, and Discover to legislative pressures and public opinion will be pivotal in shaping the future landscape of financial transactions in the firearms industry.

For gun merchants and gun retailers, staying adaptable and informed is crucial. The industry may need to continue adapting its practices and policies in response to the changing financial and regulatory environments. This could involve exploring new financial services tailored to the unique challenges posed by the new MCC and the broader context of gun sales.

Looking ahead, the integration of technology and data analytics in tracking and managing gun sales will likely become more prominent. This advancement could offer both opportunities and challenges, as it may improve transparency and compliance while also raising concerns around privacy and data security.