Who’s Involved in Credit Card Processing?

Nov 20, 2020 7 minute read

Understanding online payment processing tools and transaction flow can help increase your sales conversions.

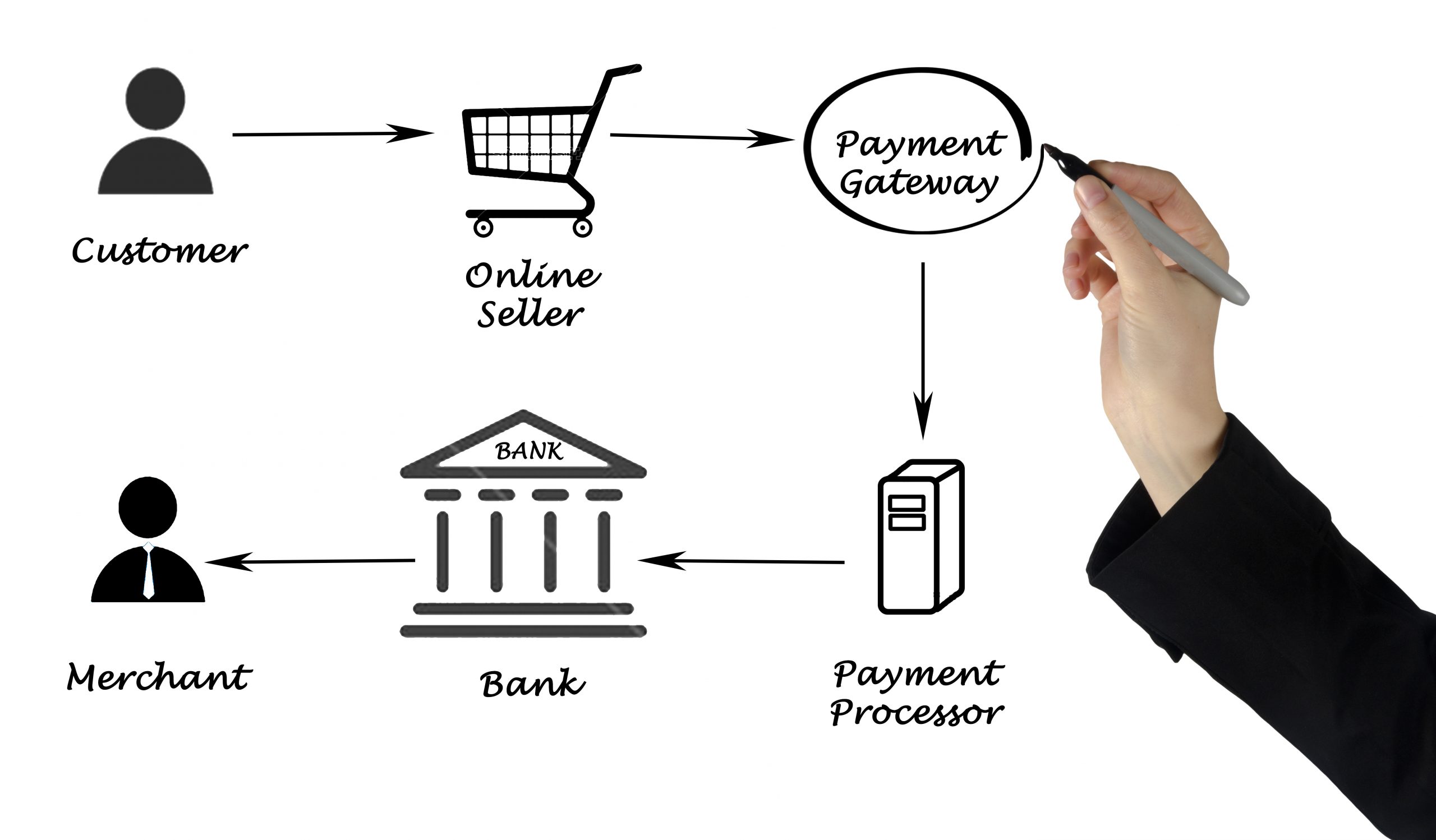

In a simple world, your online sales would go from your website directly into your bank account. In reality, credit card payment processing involves a complex process involving different software and technology partners; these are required to ensure you can collect from the customer. Each technology partner presents its own challenges and potential for losses to occur if integration is not optimized.

Many e-commerce merchants are in the dark when it comes to API’s and credit card payments. Understanding the purpose of a payment gateway and how it can increase your conversions is imperative to your online store’s success.

Merchants in high-risk industries are especially sensitive to sales conversions. Traffic cost is increasing with more competitors entering the market. It’s important to use anti-fraud tools, reporting and other features in your payment gateway. Not doing so, can lead to chargebacks, unnecessary refunds and termination from your merchant account provider.

E-commerce has changed considerably in the wake of the pandemic. Brick and mortar stores are migrating to online-only environment, ditching their point of sale equipment for virtual payment gateways. Many entrepreneurs are setting up shops online to work from home. Many e-commerce business in the fitness, business opportunity and nutraceutical niches are doing quite well. Many newer merchants make mistakes that are detrimental to their business and can result in them being placed on MATCH or the Terminated Merchant File (TMF) for high chargebacks or customer data breaches.

Are you in the dark about the differences between payment gateways and merchant accounts? Perhaps you’re lost when it comes to how payment gateways work with shopping carts?

Well, here’s a guide to understanding the ins and outs of payment gateways, how they work, and how to use them to your advantage.

What is a payment gateway?

A payment gateway is a software that takes encrypted transactions from your checkout page and passed them onto your credit card processor. Think of this as a point of sale terminal in a physical store.

The core function of a payment gateway is to be a digital cash register for online transactions. And like a traditional cash register, a payment gateway encrypts customer credit card data and ensure you get a response if a transaction is approved.

Payment gateways will achieve this function through a few steps. First, the gateway will encrypt the customer’s card information. Once this is complete, an authorization request will be sent for the credit card processing. Once the payment processor gets a green light from the customer’s bank or credit company, the transaction response is sent back to the gateway which then reports it to you, the merchant. There are several other features merchants can use in the payment gateway, such as anti-fraud tools, CVV verification, AVS (address verification service), etc. These features help lower the risk of refunds, chargebacks and fraud.

All parties involved in payment processing charge a transaction fee

● PayPal. This payment option is trusted by customers and merchants alike. It’s one of the most well-known payment gateways and boasts over 277 million accounts. Transaction fees are subject to a 2.9% rate plus $0.30, which includes payment processing plus the gateway fee.

● Square. This platform is known for its physical smartphone card-swipers for small businesses. Square currently charges 2.75% for swiped transactions and a bundled 3.5%/$0.15 fee for online-only transactions.

● Stripe. Another popular option, Stripe focuses mainly on mobile shopping and platform payments. Stripe’s bundled fee is 2.9% plus $0.30 per card transaction.

These fees are for all cards, including debit cards. These payment solutions typically do not work with businesses that are classified as high-risk such as nutraceutical, adult entertainment, subscription products, business opportunities. We get several calls a week from merchants exclaiming: “Stripe has shut me down! What do I do to keep my business running?”

A word about Shopify

Some merchants integrate their checkout pages to PayPal, Square or Stripe directly. Others prefer to use Shopify. And, it’s important to note that Shopify is not a payment gateway and requires you to work with a payment solution they are integrated with. They have several they offer although it is important to check that your payment processor and gateway is included in Shopify.

Many high-risk merchants start by using PayPal or Stripe through Shopify only to later realize they cannot scale with these payment solutions. A high-risk merchant account offers more control over the checkout process and is more flexible with ecommerce businesses selling nutraceuticals or business opportunities.

Merchant accounts same as PayPal or Stripe allow you to process transactions. Although keep in mind, a merchant account needs to be connected to a stand alone payment gateway in order to allow you to accept credit card data.

Your merchant account provider will give you a VAR sheet, which includes technical details you can use to pop into a payment gateway. Popular payment gateways include authorize.net and NMI. These gateways will allow you to accept multiple payment methods in addition to Visa and Mastercard, such as American Express, Apple Pay and even ACH so long as your payment processor supports it.

If you’re working with Shopify which requires an external gateway service, you can use 3rd party plugins such as Spreedly that will allow you to connect several payment gateways without having to integrate complicated APIs.

More alternative options

If you’re a high-risk merchant, you know that Stripe or PayPal is not an option for accepting credit cards on your website. That’s why its important if you are working with them to start looking for payment processing services that can accommodate your high-risk industry.

Working with a partner like DirectPayNet can help you scale your nutraceutical, biz op or fitness store without the worry of being shut down or suspended. DirectPayNet offers multiple gateway options that can work with Shopify and various other shopping carts. PCI compliance and processing fees are top of mind for us so we ensure you have fair fees, a secure and encrypted environment for your customers’ information.

Shoot us a message today to apply for credit card processing. Our experts can help solve any tech issue you’re facing and get you up and running within a couple of hours.

What can you expect to pay?

There’s a common misconception that a high-risk merchant account with a separate payment gateway comes with exorbitant monthly fees and unreasonable pricing.

However, if you are a responsible merchant and use all the tools at your disposal to mitigate chargebacks and refunds, many options are cheaper or competitive with Stripe or Paypal.

Startups may have to pay higher fees while payment processors assess the risk of their business, although after 4-6 months of credit card processing, your merchant account provider can review and lower fees when your performance is reviewed. If your chargeback ratio remains low, transaction fees can be adjusted to your favour.

Most popular payment gateways charge via bundled rates. For example, Stripe charges 2.9% + $0.30, no matter the card type. With your merchant services provider, there could be a different fee for debit cards vs credit cards and even card type like Discover, American Express, etc. Just ensure to read the fine print to ensure there are no hidden fees.

If you work with DirectPayNet, we will ensure to walk you through all fees and make it as simple as possible for you to get started. Business owners have enough to worry about, contact the experts at DirectPayNet to take care of your payment processing.

Credit card processing the right way

Merchants should use payment gateways as more than a bridge between a shopping cart and merchant account. In fact, most offer additional bells and whistles. They also have several external integrations to allow you to plug in your accounting software or other nifty apps to maximize value and save time.

A few key features that many platforms will offer include:

● Fraud protection and anti-fraud tools

● Tokenization that protects payment IDs

● Various software integration options such as QuickBooks to save time on accounting

● Sophisticated data and transaction reporting tools

● Recurring payment management that is PCI-compliant

● Invoicing tools

● Hosted payment forms or a virtual terminal if you don’t have a shopping cart

● Transaction detail plugins that show errors, card types, BINs, and declined purchase reasoning

Your payment processors can help guide you to find the best solution for your ecommerce business. If you need help finding the tools to navigate your online store, trust the experts at DirectPayNet.

5 thoughts on “Who’s Involved in Credit Card Processing?”