eCommerce vs. Direct Response, What’s the Difference?

Aug 16, 2023 3 minute Read

Understanding the nuances of different selling strategies has never been more essential. As our world increasingly shifts to digital realms, businesses must align their practices to reach customers effectively.

Two prevalent online sales methodologies that often stir confusion are ecommerce and direct response. Both approaches have reshaped the way businesses sell products and services, yet they cater to distinct customer behaviors and expectations.

In this post, we’ll delve into the core of ecommerce and direct response, unpacking their differences and shedding light on their implications.

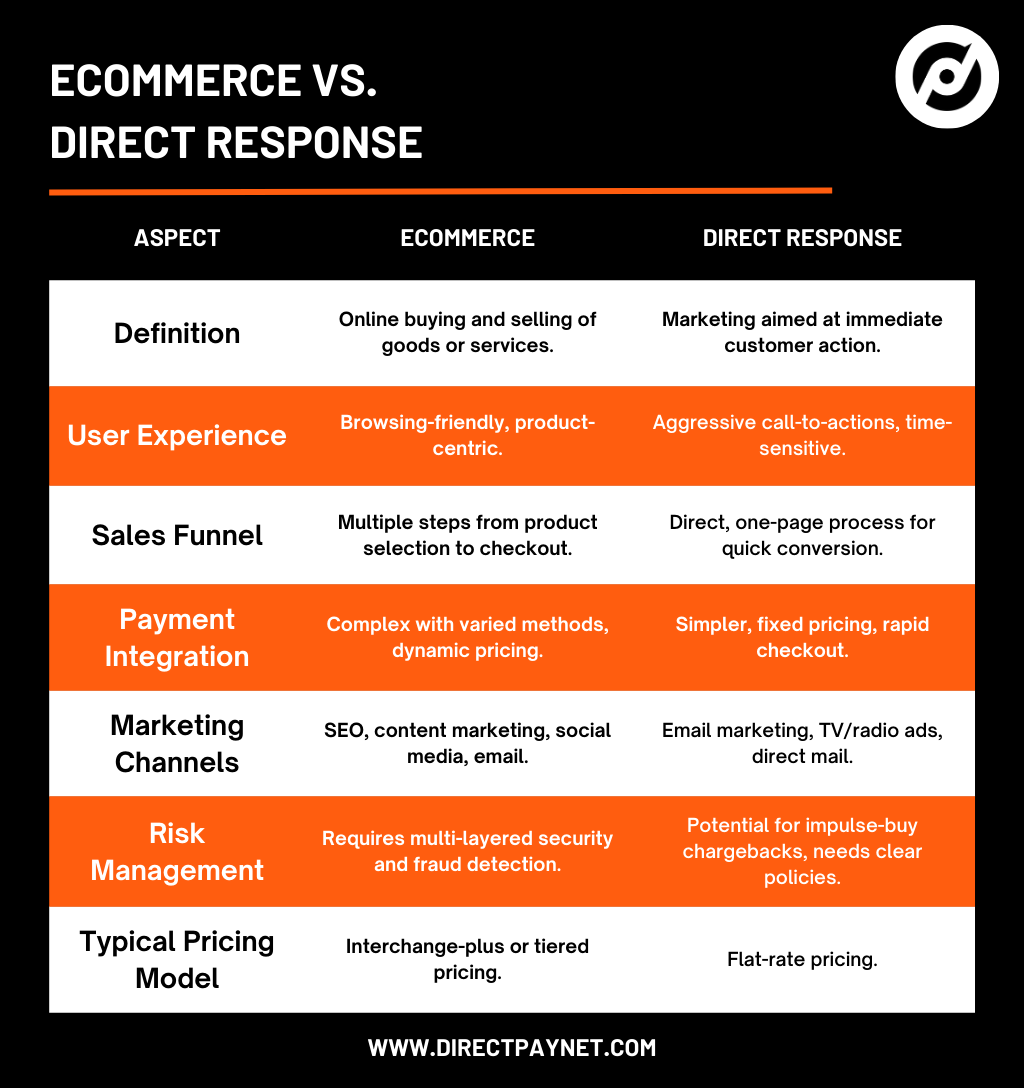

Compare ecommerce with direct response marketing.

Definitions and Core Concepts

To truly grasp the distinctions between ecommerce and direct response, it’s crucial to first understand their foundational principles. Let’s unpack the essence of each:

Ecommerce

- Definition: Ecommerce, short for electronic commerce, refers to the buying and selling of goods or services using the internet. It encompasses a wide array of online business activities for products and services.

- Overview: This methodology is centered around creating an omnichannel retail experience for the user. With ecommerce, consumers can browse through multiple products or services, read reviews, compare prices, and make purchases at their convenience. The model is often visualized as an online marketplace or store where choice and information are abundant. From massive platforms like Amazon and eBay to niche boutique shops, ecommerce offers diverse shopping experiences tailored to individual user preferences.

Direct Response

- Definition: Direct response marketing is a type of sales technique designed to evoke an on-the-spot response and encourage a prospective customer to take action, such as opting into an email list or making a purchase immediately.

- Overview: Unlike the browsing-friendly nature of ecommerce, direct response focuses on eliciting immediate action from the consumer. Every element of a direct response campaign, be it an online landing page or a TV commercial, is crafted to prompt an immediate reaction. Time-sensitive offers, clear CTAs (call-to-actions), and a sense of urgency are hallmarks of this approach. Direct response is less about the shopping experience and more about driving rapid conversions.

While both models operate online, their objectives, design strategies, and engagement tactics are distinctly different. At their core, ecommerce offers a broad shopping landscape, while direct response narrows down the journey to a single, swift action.

Key Differences Between Ecommerce and Direct Response

While both ecommerce and direct response operate in the online sphere, their modus operandi, audience engagement techniques, and overall objectives differ considerably. Below are some of the primary distinctions:

- User Experience (UX)

- Ecommerce: The user experience in ecommerce sites is designed around browsing. Platforms encourage exploration, often featuring rich visuals, detailed product listings, reviews, and recommendations. The focus is on making the consumer’s journey enjoyable, intuitive, and informative, hoping that such a pleasant experience will lead to a sale.

- Direct Response: Here, the UX is more streamlined and action-oriented. Visitors are usually presented with a singular, compelling message that prompts immediate action. This could be a sales page, a landing page for a special offer, or a time-limited discount page. The emphasis is on eliminating distractions and guiding the user swiftly to the call-to-action.

- Sales Funnel Structure

- Ecommerce: The sales funnel in ecommerce can be intricate. Consumers might first browse products, add items to their cart, maybe abandon it, come back later after an email reminder, and finally make a purchase. There are multiple touchpoints, and the journey from interest to sale can be elongated.

- Direct Response: The funnel here is more straightforward and compressed. The primary goal is to move the prospect from awareness to purchase rapidly, often in a single step. There’s minimal browsing; it’s about presenting an offer and urging an immediate response.

- Payment Integration Complexity

- Ecommerce: Given the diverse products, variations, and often the involvement of multiple sellers (in marketplaces), ecommerce sites require sophisticated shopping cart integrations. This includes support for various payment methods, dynamic pricing based on promotions, and sometimes even region-specific pricing.

- Direct Response: Payment processes in direct response campaigns are usually simpler. They involve fixed prices for the offer being presented. The checkout process is optimized for speed, often requiring minimal input from the buyer.

- Marketing and Advertising Channels

- Ecommerce: Brands relying on ecommerce often diversify their digital marketing efforts. They leverage SEO, content marketing, paid ads, social media promotions, and email marketing sequences, aiming to attract a broad audience to their platforms.

- Direct Response: Direct marketing channels are more targeted. They focus on immediate results and often revolve around channels that can deliver such outcomes — like email blasts, TV/radio commercials, direct mail campaigns, and telemarketing. The message across these channels is consistent: act now.

While both ecommerce and direct response aim to drive sales, their approaches, from user experience to marketing campaigns, are tailored according to their distinct objectives and audience behaviors.

Implications for Payment Processing and Merchant Accounts

The differences between ecommerce and direct response are not just superficial; they have profound implications for payment processing and the management of merchant accounts. From transaction dynamics to risk considerations, each method presents its own set of challenges and opportunities.

- Risk Management

- Ecommerce: Given the elongated sales funnels and diverse product offerings, ecommerce transactions can sometimes be susceptible to cart abandonment, fraud, or unauthorized transactions. Merchant providers need to ensure that they have multi-layered security protocols in place, from SSL certificates to fraud detection mechanisms.

- Direct Response: Given its immediate nature, direct response marketing strategies can sometimes attract impulsive buyers who might later regret their purchases, leading to potential chargebacks. Additionally, the high-pressure sales tactics sometimes employed can lead to increased scrutiny from payment processors.

- Pricing Models

- Ecommerce: Ecommerce merchants often deal with a variety of pricing models based on the nature of their goods or services, sales volume, and transaction amounts. Interchange-plus pricing or tiered pricing models might be preferred due to the variability in transaction types and sizes.

- Direct Response: Given the more straightforward nature of transactions, flat-rate pricing can often be suitable for direct response merchants, making it easier to predict costs.

- Chargebacks and Disputes

- Ecommerce: While ecommerce platforms try to provide as much product information as possible, there’s still a potential for product returns due to dissatisfaction or misalignment with expectations, leading to chargebacks. Efficient dispute resolution processes and clear return policies are crucial.

- Direct Response: As mentioned, the impulsive nature of some purchases can lead to buyer’s remorse. Direct response merchants should be prepared for higher chargeback rates and should consider incorporating clear refund policies and customer education to mitigate this.

- Fraud Prevention

- Ecommerce: With a vast audience and a myriad of products, ecommerce platforms can be targets for various fraudulent activities, from account takeovers to fake product listings. Payment processors must offer advanced fraud detection tools, like Address Verification Services (AVS) and Card Verification Value (CVV) checks.

- Direct Response: While the fraud types might be different, direct response campaigns aren’t immune. Quick transactions can sometimes be exploited by fraudsters using stolen card details, expecting the rapid transaction pace to bypass thorough checks. Hence, real-time fraud detection becomes pivotal.

In light of these implications, it becomes evident that merchants must not only choose their sales method wisely but also align with a payment processor that understands the nuances of their chosen approach. This ensures seamless transactions, optimized costs, and robust risk management.

No Matter Your Method, You Need a Payment Processor That Supports Your Business

Understanding the nuanced differences between ecommerce and direct response is not just beneficial — it’s essential. Both methodologies offer unique advantages and challenges, from the user experience front to the intricacies of payment processing.

If you’re leaning towards the swift, compelling realm of direct response, it’s crucial to partner with a payment processor that genuinely understands its dynamics. With DirectPayNet, you’re not just getting a merchant account; you’re investing in a partnership tailored for the fast-paced, action-oriented world of direct response marketing. We ensure that every transaction is swift, secure, and optimized for your specific needs.

So, why wait? Embrace the potential of direct response with a payment processing solution that’s crafted for its success. Open a direct response merchant account with DirectPayNet today and unlock the next level of growth for your small business.

5 thoughts on “eCommerce vs. Direct Response, What’s the Difference?”