- CREDIT REPAIR

- DEBT COLLECTION

- DEBT CONSOLITATION

- HIGH RISK MERCHANT ACCOUNT

- PAYMENT PROCESSING

- VIRTUAL TERMINAL

Fraud Causing Havoc for Debt Consolidation Merchant Accounts

Aug 9, 2019 4-MINUTE READ

As consumer debt continues to soar in America, so too does the need for debt consolidation merchant accounts. Legitimate debt consolidation companies like yours may be helping thousands of Americans refinance and clear their debt in an easier fashion. However, crooked debt collection agencies are causing havoc. The issues with these agencies have resulted in a harder than necessary method for attaining payment processing.

Acquiring banks and other payment providers all label companies in this industry as high risk. This, of course, limits options to accept payments. So, the reputational and financial liability risks posed by debt consolidation companies make it difficult to get approved for a merchant account or other methods of payment. The good news is that while it may be difficult, it’s not impossible. There are payment providers who do service high-risk merchants in the debt consolidation and collection verticals.

How big is the consumer debt industry?

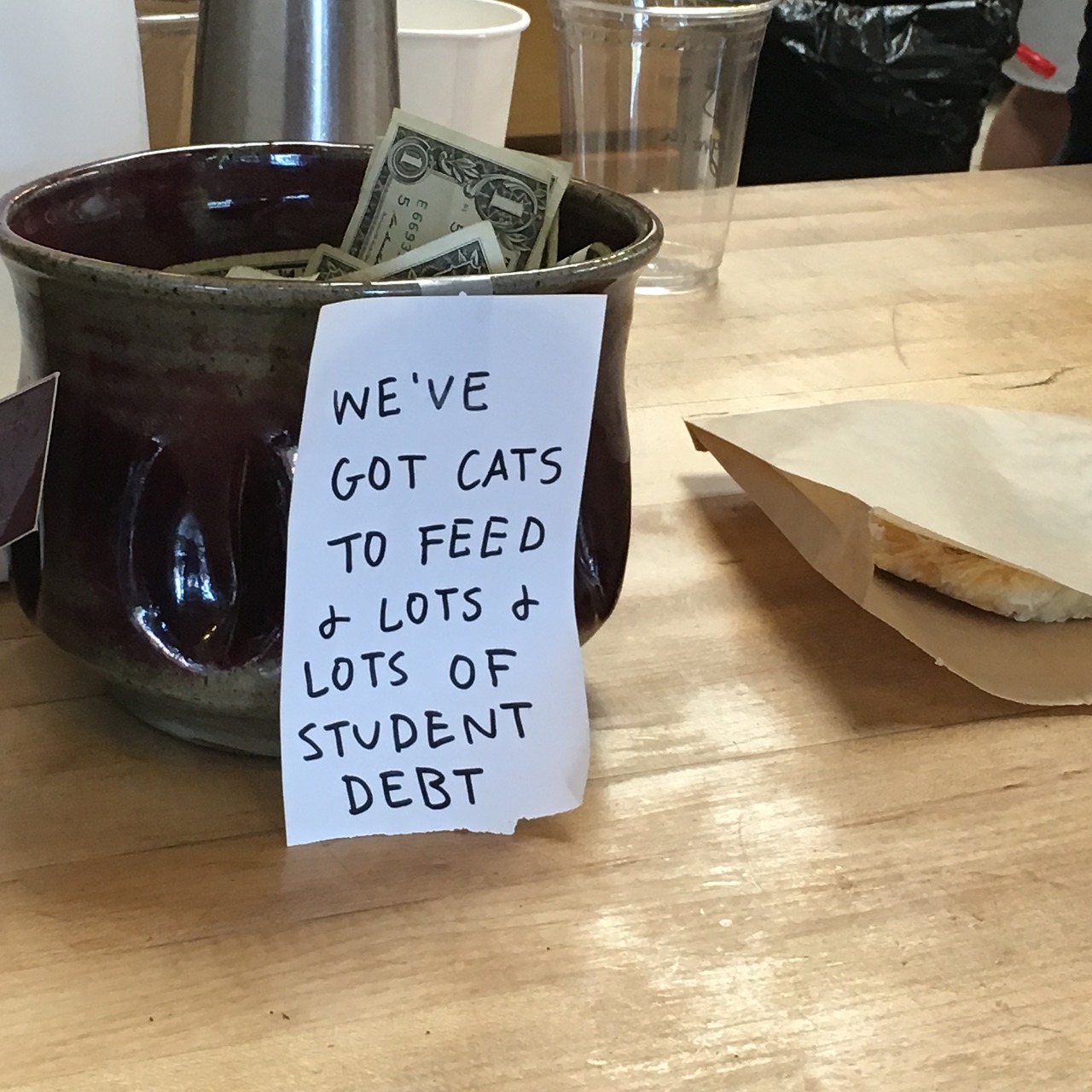

According to the Federal Reserve, consumer debt came in at $2.6 trillion in 2018. While credit card debt is the most common liability, American student loan debt has reached an all-time high. More than 44.7 million borrowers owe over $1.56 trillion. This makes it the second highest consumer debt category. Undoubtedly, the growing indebtedness of Americans has prompted the growth of debt collection agencies across the US.

Similarly, in Canada, household debt stood at $2 trillion in 2018. Mortgages accounted for nearly three-quarters of the debt. Canadian federal student loans also hit at an all-time high. So, it’s not surprising that the Canadian debt consolidation and collection industry are also on an upward trajectory.

And, where there are booming industries, problems tend to follow.

Some of the issues in the debt collection industry

Debt consolidation and collections are high-risk verticals. They operate in an “underregulated environment.” In other words, the industry is prone to fraud and abuse. Therefore, alongside legitimate agencies attempting to help debtors (and make a profit, of course), there are the dishonest ones. The activities of these agencies have led to stories like these from the US Federal Trade Commission:

FTC Stops Student Loan Debt Relief Scheme, Charges Operators with Misleading Consumers (source)

Ringleader of Student Loan Debt Relief Scheme Liable for $11 Million in Settlement of FTC Charges (source)

The list of companies and individuals banned by the FTC from undertaking debt relief activities is lengthy. Debt collection and consolidation faces is plagued by excessive fraud, chargebacks and customer disputes.

These issues, of course, lead to complications for payment processing.

Industry problems increase the vulnerability of debtors. This, in turn, makes the approval process in the industry that much harder. This is why to be approved to accept online or Mail/Telephone orders (MOTO) from debtors, your debt collection or consolidation agency must present a transparent and reliable brand to payment processors. In spite of the issues, all is not lost for medium and large-sized high-risk merchants like you who specialize in debt consolidation and collection. After all, some payment providers do approve this business category.

Before we go into making sure you can get an approved for payment processing, let’s look at ways to diversify your payment options.

How you can diversify your payment channels

Most high-risk merchants that deal with consumer debt tend to focus on virtual terminals to collect payments. The majority of virtual terminals are PCI compliant and secure. Additionally, they allow you to accept payments over the phone. But, there are other payment methods you can consider offering your debtors.

- E-checks & ACH Payment: We’ve reviewed the benefits of accepting an e-check payment in this post for high-risk merchants. It’s a great alternative to accepting card payments because debtors are debited directly from their bank account to yours. Keep in mind that these methods are only available in the US.

- Recurring billing: Implementing systems for automatic charges improve productivity. With reliable debtors, it makes the payment collection process easier.

Diversifying your payment options is one thing. Start looking at how to present your business in a manner that improves your chances of getting and keeping your merchant account.

What you need to do to show the legitimacy of your business

Website Compliance

Having your very own merchant account will facilitate orders directly to your website. As such, your website must have all the key components (e.g. clear terms and conditions, refund policies, etc.) to get approval from a provider. Additionally your CRM must be PCI-DSS compliant, but also make sure that whichever processor you work with is also approved to accept payments online.

Comply with industry regulations

State and Federal compliance requirements for debt collection agencies in the USA are continually evolving. So, you need to stay abreast of the state laws, government regulatory agencies requirements, and federal regulations. For example – and we know you know this – do not use abusive, deceptive, or unfair debt collection practices as set out by the Fair Debt Collection Practices Act (FDCPA).

Of importance also is the Consumer Financial Protection Bureau’s (CFPB) requirement that agencies of all sizes must implement a compliance management system. This may require additional resources or working with a company that understands your market and high-risk merchant accounts in general.

Build good processing history

A good processing history can encourage your merchant account or other payment provider to increase the limit on your single ticket and monthly volume. So, you could have individuals paying you above $300 or $500 per transaction. Also, if your limit for monthly transactions online is currently below $100,000, your payment processing history can help you get that increased.

However, what if you don’t yet have a solution? Or want to find out about alternatives to your current debt consolidation merchant account?

Get approved for a debt consolidation merchant account

As we’ve noted, debt consolidation merchants often face rejection when they try to get approved for payment processing services on their own. To overcome this, you need to work with an expert in high-risk merchant accounts.

In doing so, focus on one that can offer:

- Fraud prevention solutions;

- Chargeback prevention and protection; and

- Access to multi-bank processing or offshore banking.

5 thoughts on “Fraud Causing Havoc for Debt Consolidation Merchant Accounts”