Imagine this: You’ve just started your online store and decided to use Stripe for payment processing. Fast forward a few months, and you’re excitedly checking your earnings only to find that a significant chunk of your profits has vanished into thin air!

Stripe is no doubt one of the giants in the payment processing world. With its slick interface, a plethora of features, and the ease with which it can be integrated into almost any website, it’s no wonder that countless online merchants and e-commerce platforms opt to use Stripe payment processing as their go-to solution.

Every business on Earth has heard of Stripe, and many of those businesses use it (whether they know it or not). It’s one of the most popular payment processors in the world, trusted by startups and big brands alike for its fast setup and powerful features.

But while Stripe makes it easy to accept payments, many business owners ask: How much does Stripe charge per payment? Understanding Stripe pricing and the true cost of each transaction is one of the smartest things you can do for your bottom line.

Whether you’re just starting out or looking to optimize your payment setup, knowing how Stripe fees work will help you make smarter decisions for your business.

In this article, we’ll shine a light on the maze that is Stripe’s fee structure, and arm you with the information you need to make an informed decision for your business. We’ll break down each fee, analyze whether Stripe is really as expensive as some claim, and provide you with viable alternatives that could save you money without compromising on quality.

Stripe Fees Breakdown

Stripe has a reputation for its simplicity and ease of use, but when it comes to Stripe pricing, things can get a bit more complicated. Let’s unravel Stripe’s flat-rate pricing model and its variety of fees to finally answer the question: What percent does Stripe take?

What is Flat Rate Pricing?

At its core, Stripe operates on a flat-rate pricing model. This means that for every online transaction, you’re charged a fixed percentage plus a fixed fee. The standard Stripe rates for online transactions are 2.9% + 30 cents per successful charge for businesses in the United States.

However, it’s worth noting that Stripe payment processing fees can vary by country, so it’s important to check Stripe’s pricing page for the most current rates applicable to your location.

Additional Service Fees

Besides the basic Stripe transaction fees, Stripe offers additional services that come with their own set of costs:

- Stripe Radar: This is Stripe’s fraud prevention tool. While basic Radar features are included in the transaction fees, Radar for Fraud Teams, which offers more advanced capabilities, costs an additional fee per transaction.

- Stripe Billing: If you’re using Stripe for subscription services, Stripe Billing can handle recurring billing. The cost for this service depends on your usage, with a percentage fee charged on recurring charges.

- Stripe Connect: This is ideal for platforms that need to payout to third parties. It’s an intricate service with a variable pricing structure that depends on the features you’re using.

Hidden Costs

There are several Stripe processing fees that you might not be aware of when you start using Stripe:

- Currency Conversion Fees: If you’re accepting international payments in a currency different from your account’s default currency, Stripe charges an additional conversion fee.

- Chargeback Fees: In case of a disputed charge, such as when a customer doesn’t recognize a transaction, there is a fee for the chargeback process. If the dispute is resolved in your favor, the fee may be refunded.

- Refund Processing Fees: If you refund a transaction, Stripe doesn’t return the original transaction fee. This means you lose the processing fees of the original charge.

The Premium Package Rates

For larger merchants processing over $1 million annually, Stripe offers customized Premium pricing which can provide lower Stripe rates:

- Interchange+ model passing through interchange fees plus a markup percentage

- Potential for lower overall fees, especially for qualified card-present rates

- Customized pricing evaluated based on projected volume, business model, risk factors

The Premium pricing utilizes interchange-plus or cost-plus pricing, where the merchant pays the actual interchange and assessment fees from the card networks plus Stripe’s markup percentage. This model can yield savings compared to Stripe’s standard rates for high-volume merchants able to qualify for the lowest interchange pricing tiers.

Non-Negotiable Fees

While Stripe does offer customized Stripe pricing for some high-volume enterprise merchants, their standard rates are generally fixed and non-negotiable, especially for small to medium-sized businesses. Stripe takes a straightforward approach to pricing without complex tier systems or long-term contracts.

The transparency and simplicity of Stripe’s pricing model is one of its key advantages, allowing businesses to easily forecast costs. However, it also means there is little room for negotiating lower baseline fees based on volume or tenure as a customer.

The same rings true for Stripe’s top competitors in the 3rd-party credit card processing industry; PayPal and Square.

Real-Life Impact of Stripe Fees

To paint a clearer picture of how much does Stripe charge in practice, let’s consider a practical example. Imagine you are a US-based merchant with an average transaction value of $50. If you process 100 transactions in a month, your base Stripe transaction fees alone will be around $320 [(2.9% of $50 + $0.30) x 100]. If you have a couple of chargebacks, need currency conversions, or use additional services, this figure can escalate quickly.

It’s essential to be aware of these costs and factor them into your pricing strategy. Knowing how much each transaction actually costs you can help in making informed decisions regarding the payment processors you choose.

Looking for a way out of Stripe without harming your business? We can help!

How to Lower Your Stripe Payment Processing Fees

While Stripe rates are competitive, there are several strategies businesses can employ to further reduce their Stripe payment processing fees.

Strategies to Reduce Costs

- Encourage customers to use payment methods with lower fees like ACH direct debit or digital wallets.

- Batch and schedule non-urgent payouts to take advantage of lower fees.

- Properly categorize transactions to qualify for lower interchange rates.

- Avoid unnecessary currency conversions by using multi-currency pricing.

Contacting Stripe for Preferential Pricing

For high-volume merchants processing over $1 million annually who are dead-set on using Stripe (even if we warn you not to at that volume), it may be worthwhile to contact Stripe’s sales team to request preferential pricing. Stripe evaluates these requests on a case-by-case basis factoring in projected volume, business model, and other criteria.

The Importance of PCI Compliance

Maintaining full PCI DSS compliance is crucial for avoiding unnecessary fees and fines from payment brands. Non-compliance can lead to higher Stripe transaction fees and monthly fees. Investing in security best practices pays off through lower overall processing costs.

How to Optimize Your Payment Processing

In addition to reducing baseline Stripe fees, there are several optimization strategies businesses can employ to further decrease costs with Stripe.

Utilizing Alternative Payment Methods

While credit and debit cards are popular, they often come with higher processing fees compared to methods like ACH direct debit (0.8%), digital wallets (1%), and bank transfers/wires. Offering and incentivizing these lower-cost options can significantly reduce your overall Stripe payment processing fees.

Understanding Dispute and Chargeback Fees

Chargebacks can be costly, with Stripe charging $15 per dispute in addition to the transaction amount. Implementing fraud protection tools, clear refund policies, and excellent customer service can help mitigate chargebacks. Disputing illegitimate chargebacks is also advisable to avoid unnecessary fees.

Reviewing and Renegotiating Statement and Annual Fees

Stripe charges monthly statement fees, annual fees, setup fees, and other recurring costs (as does most providers). Periodically reviewing these ancillary charges with your Stripe account manager ensures you are not overpaying. For high-volume merchants, renegotiating or waiving some of these fees may be possible.

Should You Expand Your Payment Options?

While credit cards remain the dominant payment method for many businesses, expanding your accepted payment types can unlock significant cost savings on Stripe fees and cater to diverse customer preferences.

Adding Alternative Payment Processing Methods

Integrating digital wallets like Apple Pay, Google Pay, and popular Buy Now Pay Later services like Klarna allows you to process those transactions at lower Stripe rates compared to credit cards. ACH bank debits and wire transfers also tend to have much lower fees.

Market-Specific Payment Modes

Different geographic markets may have entrenched local payment preferences. For example, iDEAL is a leading online bank transfer method in the Netherlands. Accepting these regional payment options can reduce cross-border fees and enhance the checkout experience for international customers.

Expanding your international payment processing capabilities is a wise strategy to reduce Stripe’s cut of each sale while also improving conversion rates and providing payment flexibility for your global customer base.

Cost-Plus Pricing Strategy

For some larger merchants, Stripe offers customized cost-plus pricing that can potentially reduce Stripe payment processing fees compared to their standard rates. However, this option requires meeting certain criteria.

Exploring Cost-Plus Pricing with Stripe

Stripe’s cost-plus pricing model passes through the actual interchange and assessment fees from the card networks to the merchant, plus a fixed markup percentage. This can yield savings for businesses with significant transaction volumes, particularly for qualified rates.

To be eligible, merchants generally need to process over $1 million annually and have very low chargeback rates. Stripe evaluates cost-plus pricing requests individually based on projected volume, average ticket size, customer verticals, and other risk factors.

Transaction Types and Customer Data

The fees on a cost-plus plan can vary significantly based on transaction types (e.g. card-present vs card-not-present) and the data transmitted. Providing complete billing/shipping details and level 3 line-item data can help qualify for lower interchange rates from the card brands.

Level 2/3 Data and Fee Reductions

Businesses able to pass along level 2 and level 3 transaction data pay lower interchange rates compared to those only providing level 1 data. This richer data allows the card networks to better categorize and qualify each sale.

Is Stripe Really Too Expensive?

Now that we’ve broken down the various fees associated with using Stripe, it’s time to address the elephant in the room: Is Stripe pricing really too expensive for your business? The answer to this question is not a simple yes or no, as it depends on several factors including the scale of your business, your specific needs, and what you value in a payment processor.

Value and Services vs. Cost

One of the reasons why Stripe is a popular choice among online merchants is the suite of tools and features it offers. From seamless integration, a robust API, to fraud prevention with Stripe Radar, there’s a lot that comes packaged with Stripe’s service. For some businesses, these features may justify the costs, as they can contribute to smoother operations and potentially higher conversions.

However, for small businesses or those with tight margins, the costs can add up quickly and become a significant burden. In such cases, the value provided by Stripe may not justify its fees.

Nor does the abysmal Stripe support process. The company can hold your funds for 180 business days and makes it nearly impossible to get in touch with them.

Stripe’s Tools and Features: Useful, But Often Underused

Stripe offers a powerful suite of tools and features designed to help businesses go far beyond basic payment processing. From advanced billing automation to fraud protection, tax compliance, and global payment support, Stripe has built an ecosystem that can handle almost every aspect of getting paid online.

But here’s the catch: most businesses don’t take full advantage of what Stripe can do, either because they don’t need all the extras, or they simply aren’t aware of them.

What Does Stripe Offer?

- Billing and Subscriptions: Stripe Billing lets you automate recurring payments, send invoices, and manage subscription logic. You can set up custom billing cycles, automate reminders, and even handle complex pricing models.

- Fraud Protection: With Stripe Radar, you get machine-learning-powered fraud detection that improves as more businesses use Stripe. This network effect helps spot fraud quickly, protecting your revenue.

- Tax and Compliance: Stripe Tax automatically calculates and collects the right amount of sales tax, VAT, or GST based on your customer’s location, and keeps your invoices compliant with local regulations.

- Global Payment Methods: Stripe supports a wide range of payment methods — credit cards, bank transfers, digital wallets, and even local payment options — making it easy to sell to customers all over the world.

- Custom Checkout and Reporting: Stripe Checkout provides a customizable, secure payment page, while tools like Stripe Sigma give you insights into your payment data for better decision-making.

- Seamless Integrations: Stripe connects with popular accounting software and other business tools, automating everything from invoice syncing to expense tracking and reconciliation.

Why Are These Features Underused?

- Lack of Awareness: Many businesses sign up for Stripe just to accept payments and never explore the additional features available to them.

- Simplicity Over Complexity: Small businesses and startups often don’t need advanced billing, tax, or reporting tools, so they stick to the basics.

One thing to keep in mind: Whether you use Stripe’s advanced features or not, you pay the same flat processing rate. This means businesses might end up paying for tools they don’t use, since the cost is baked into every transaction.

Stripe Pricing vs. Interchange Plus

Stripe has historically been known for its flat-rate pricing model, just like PayPal and Square. But as of 2024, Stripe pricing now includes both flat-rate and interchange-plus options — giving merchants more flexibility in how they pay for payment processing.

In fact, Stripe isn’t a traditional payment processor at all. It’s what we call a payment aggregator. But with the addition of interchange-plus pricing, Stripe is moving closer to how dedicated merchant account providers have always operated.

Most businesses start on Stripe’s standard flat rate of 2.9% + $0.30 per online transaction. However, higher-volume merchants can now request to switch to an interchange-plus (IC+) model, where you pay the actual interchange and card brand fees plus a fixed Stripe markup. Some credit card payment processors charge a separate fee for each payment type, which can be a good thing depending on what your customers use most frequently. For example, you may pay more in Stripe transaction fees for ACH direct debit and international cards, or even something as common as American Express, than on another processor.

It’s important to note that switching pricing models on Stripe isn’t always straightforward. Some merchants report that once they move to interchange-plus, Stripe won’t revert them back to flat-rate pricing — so be sure to understand your true interchange costs before making the switch.

What is Interchange Plus?

To grasp why interchange plus pricing could benefit your business, you need to understand how it works. Interchange plus pricing breaks down your payment processing fees into two main components: the interchange fee and the processor’s markup.

“Interchange”

Interchange fees form the base cost of processing a transaction. Card networks like Visa and Mastercard set these fees, which vary depending on factors such as card type and transaction method. Your payment processor can’t control or negotiate these fees.

“Plus”

The “plus” in interchange plus refers to the processor’s markup. This is a transparent, agreed-upon fee that the processor charges on top of the interchange rate. You’ll typically see this expressed as a percentage plus a flat fee per transaction, such as “interchange + 0.3% + $0.10.”

The Difference

While Stripe now offers both models, understanding the difference is still critical. Flat-rate pricing bundles all costs into a single, simplified fee — often around 2.9% + $0.30 per transaction for online sales. While this approach simplifies billing, it can often result in higher overall costs for merchants, since you pay the same rate whether a customer uses a low-cost debit card or a high-reward premium credit card.

Interchange plus pricing offers several advantages:

- Transparency: You see exactly what you’re paying in interchange fees and processor markup.

- Cost-effectiveness: For many businesses, especially those with higher average transaction values, interchange plus often results in lower overall fees. Some estimates suggest savings of around 25% compared to flat-rate pricing.

- Flexibility: As your business grows, you can negotiate better rates on the markup portion of your fees.

Customization and Negotiation

While Stripe now offers interchange-plus pricing, it’s typically reserved for higher-volume merchants — and the cost may still be higher than going with a dedicated merchant account provider. If you process tens of thousands per month, it’s worth comparing Stripe’s IC+ rates against a traditional merchant account with interchange-plus pricing. In fact, it might be harmful to keep using Stripe as your primary payment processor, as Stripe has been known to freeze accounts and hold funds for businesses who process high volumes.

Your Business Needs

In the end, whether or not Stripe fees are too expensive boils down to your specific business needs. If the features, integrations, and security provided by a Stripe account are critical for your business operations and customer experience, the costs may be justifiable — especially now that interchange-plus pricing is an option. However, if you’re operating on slim margins and don’t require the full suite of services that Stripe offers, you might find better value in an alternative solution.

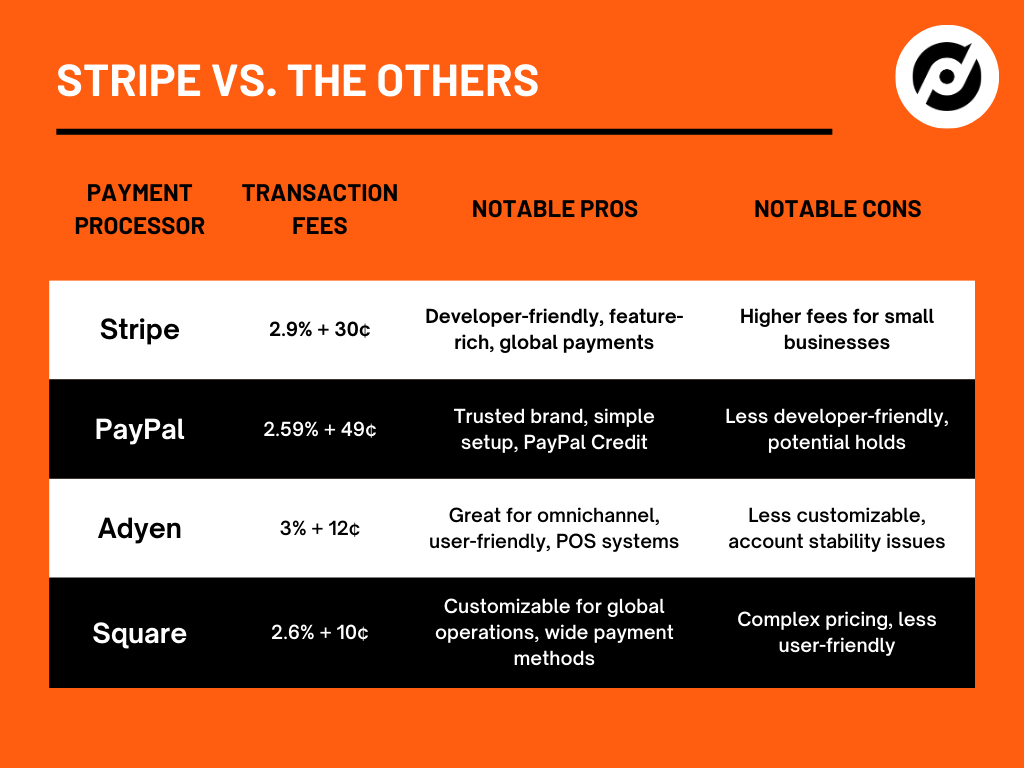

What are Stripe’s Main Competitors?

As a business owner, it’s always smart to weigh your options. Though Stripe is a formidable player in the payment processing arena, it’s not the only game in town. Let’s take a closer look at some of Stripe’s major competitors and see how they stack up in terms of pricing and Stripe fees.

It’s worth noting that all of the alternatives (as well as Stripe) accept every major credit card (Visa, Mastercard, Amex), Apple Pay, and Google Pay.

PayPal

One of the most recognized names in the online payments industry, PayPal is often the go-to alternative to Stripe.

Fees Breakdown: PayPal’s standard transaction fees are similar to Stripe’s at 2.59% + $0.49 per transaction for sales within the US.

Pros:

- Highly recognized and trusted by consumers.

- Simple setup, doesn’t require a merchant account.

- Offers PayPal Credit to customers.

Cons:

- PayPal’s interface and customization options are not as developer-friendly as Stripe’s.

- May hold funds under certain circumstances, which can affect cash flow.

Square

Square is best known for its point-of-sale (POS) systems, but it also offers a robust online payment processing solution.

Fees Breakdown: Square’s fees for online transactions are similar to both Stripe and PayPal at 2.6% + $0.10 per transaction.

Pros:

- Excellent for businesses with both online and physical storefronts.

- Feature-rich POS systems.

- User-friendly interface.

Cons:

- Not as customizable or developer-friendly as Stripe.

- Some users report issues with account stability.

Adyen

Adyen is a global payment company that allows businesses to accept payments in multiple currencies, both online and in physical stores.

Fees Breakdown: Adyen has a different fee structure compared to Stripe. It charges a processing fee plus a payment method fee, which varies depending on the payment method used, but we can generalize at 3% + $0.12 per transaction.

Pros:

- Highly customizable and feature-rich for global operations.

- Supports a wide variety of payment methods.

- Capable of handling large payments.

Cons:

- More complex pricing structure which can be confusing.

- Not as user-friendly for those without technical expertise.

Need help choosing an alternative? Reach out to our team!

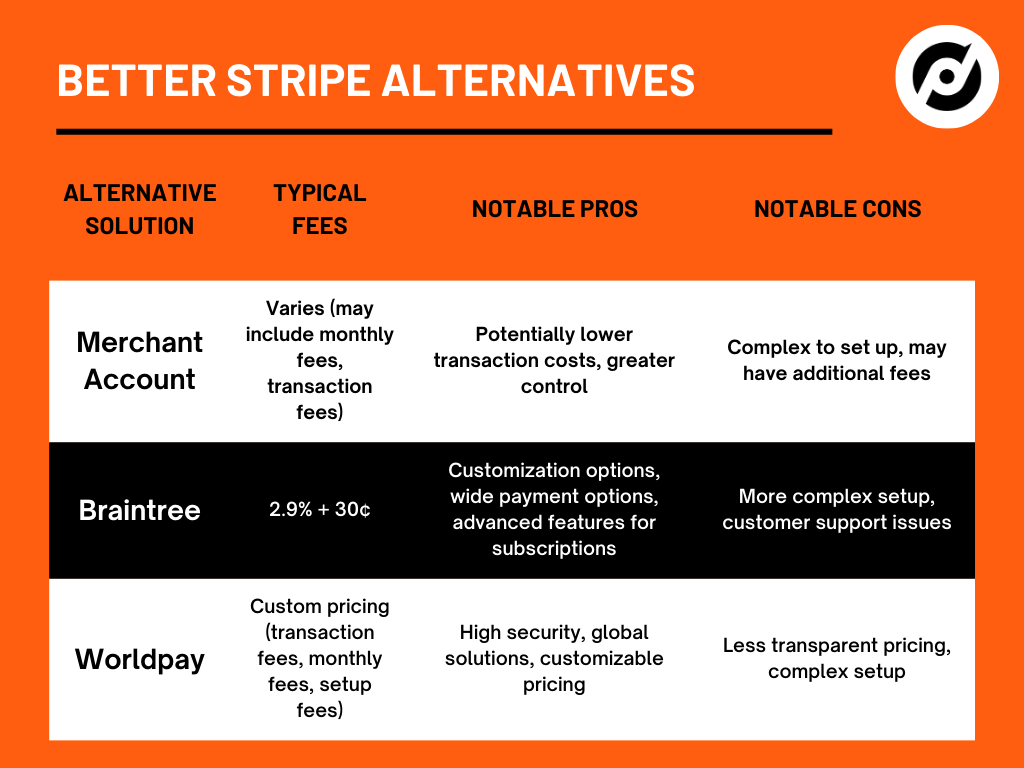

What is the Best Alternative to Stripe?

While the competitors we discussed earlier are similar to Stripe in many ways, there are also alternative solutions that operate on different models. For some businesses, particularly those with higher payment volumes or specific needs, these alternatives might offer better Stripe rates or be better suited overall.

Merchant Accounts

One of the traditional alternatives to payment processors like Stripe is to set up a merchant account.

What is it? A merchant account is a type of bank account that allows businesses to accept payments via credit or debit cards. Merchant accounts often involve relationships with banks and credit card networks.

Fees Breakdown: Merchant accounts generally have a more complex fee structure, which can include monthly fees, transaction fees, and other costs. However, they may offer lower transaction fees, especially for businesses with higher sales volumes.

Pros:

- Lower transaction costs for high-volume businesses.

- Greater control over transactions (including international transactions).

- More stability and fewer account holds.

Cons:

- More complicated to set up and manage.

- May have additional monthly or annual fees.

- Typically requires more administrative work.

Braintree

Though technically part of PayPal, Braintree operates as a distinct service catering primarily to businesses looking for a more customizable payment solution.

Fees Breakdown: Braintree’s fees are similar to Stripe’s at 2.9% + $0.30 per transaction for US transactions.

Pros:

- Provides more customization options compared to PayPal.

- Supports a wide variety of payment options.

- Advanced features for subscription services.

Cons:

- Slightly more complex to set up compared to Stripe or PayPal.

- Customer support is not always as responsive.

Worldpay

Worldpay is a global payment processing provider catering to businesses of all sizes, with a special emphasis on security and fraud protection.

Fees Breakdown: Worldpay offers custom pricing, so fees vary. They may include transaction fees, monthly fees, and setup fees.

Pros:

- Highly secure and focused on fraud prevention.

- Offers global payment solutions.

- Customizable pricing can be advantageous for some businesses.

Cons:

- Pricing is less transparent.

- Can be more complicated to set up and manage.

When considering an alternative to Stripe, it’s crucial to assess not just the cost but also the features, security, and the compatibility with your unique business model. While merchant accounts might offer cost benefits and customization options, they do come with added complexities.

Solutions like Braintree and Worldpay might be more suited for businesses with specific needs around customization, security, and global operations. As always, make sure to verify current fees and features before making your decision.

Frequently Asked Questions About Stripe Fees

How much does Stripe charge per transaction?

The standard Stripe transaction fees for online payments in the United States are 2.9% + $0.30 per successful charge. For in-person payments, Stripe charges 2.7% + $0.05. These rates may vary by country and payment method, and additional fees can apply for services like currency conversion, chargebacks, and advanced fraud protection.

What is Stripe pricing based on?

Stripe pricing is based on a flat-rate model, meaning every transaction is charged the same percentage plus a fixed fee regardless of card type, brand, or issuing bank. This differs from interchange-plus pricing, where fees vary depending on the specifics of each transaction. For businesses processing over $1 million annually, Stripe may offer custom pricing with potentially lower rates.

Are Stripe rates negotiable?

For most small to medium-sized businesses, Stripe rates are fixed and non-negotiable. However, high-volume merchants processing over $1 million per year may be eligible for custom interchange-plus pricing by contacting Stripe’s sales team. The negotiated rates depend on your projected volume, business model, average ticket size, and risk profile.

What are the hidden Stripe fees I should know about?

Beyond the standard Stripe fees, there are several additional costs to watch for. These include currency conversion fees for international transactions, chargeback fees of $15 per dispute, the fact that refunded transactions do not return the original processing fee, and add-on charges for services like Stripe Radar for Fraud Teams, Stripe Billing, and Stripe Connect. Being aware of these hidden costs is essential when calculating your true Stripe payment processing fees.

How much does Stripe charge compared to PayPal and Square?

When comparing how much does Stripe charge versus its competitors: Stripe’s standard online rate is 2.9% + $0.30, PayPal charges 2.59% + $0.49, and Square charges 2.6% + $0.10 per transaction. The best option depends on your average transaction size, volume, and whether you need in-person or online processing. For smaller transactions, Square’s lower fixed fee may save money, while for larger transactions, the percentage rate matters more.

How can I reduce my Stripe payment processing fees?

There are several ways to reduce your Stripe payment processing fees: encourage customers to use lower-cost payment methods like ACH direct debit or digital wallets, provide Level 2/3 transaction data to qualify for lower interchange rates, maintain PCI DSS compliance to avoid penalty fees, minimize chargebacks through fraud prevention and clear refund policies, and consider switching to a merchant account with interchange-plus pricing if you process high volumes.

Ready to Move Away from Stripe?

Deciding on the right payment processor is pivotal for your online business. While Stripe offers an array of features and simplicity, it’s essential to weigh the costs against the benefits, and consider if there might be a more fitting solution for your specific needs and scale.

For businesses operating in high-risk industries, traditional payment processors like Stripe, PayPal, or Square might not be the most favorable options due to their policies and fee structures. In such cases, a high-risk merchant account can provide the flexibility and support that high-risk businesses require.

DirectPayNet specializes in high-risk merchant accounts, offering customized solutions that are tailored to the unique challenges and requirements of high-risk industries. If your business operates in a space that’s considered high-risk, or if you’re experiencing issues with account holds, excessive fees, or a lack of specialized support, opening a high-risk merchant account with DirectPayNet could be the game-changing move for your business.

Here’s why DirectPayNet stands out:

- Expertise in High-Risk Industries: DirectPayNet has years of experience serving high-risk industries, understanding the intricacies and challenges involved.

- Customized Solutions: With DirectPayNet, your payment processing solution is tailored to your business, ensuring that it aligns with your specific needs.

- Dedicated Support: High-risk businesses often require specialized support, and DirectPayNet offers dedicated account managers to assist you through every step.

Your checkout is one of the most important—yet overlooked—aspects of your sales funnel. Don’t leave it to chance, secure the credit card processing power you need right now.

Take the next step and contact DirectPayNet to discuss how a high-risk merchant account can elevate your business to new heights.