How the Payment Methods You Accept Reflects the Quality of Your Small Business

Aug 11, 2023 4 minutes

If there’s one thing we’ve learned in the field of payment processing, it’s that how you accept your customer’s money can speak volumes about your business. As a veteran merchant account provider, I’ve seen it all – the good, the bad, and the unfortunately outdated.

The methods by which a small business accepts payments aren’t just logistical choices; they’re a direct reflection of the business’s commitment to customer convenience, technological adaptation, and overall service quality. In the world where customers have an array of options to part with their hard-earned money, the phrase ‘Cash or Card?’ barely scratches the surface.

Importance of Diverse Payment Methods

By offering a broad palette of payment options, you’re essentially rolling out the red carpet for your customers, inviting them to transact in the manner they feel most comfortable.

Offering only one or two payment options could lead to missing out on sales. Imagine a customer finding the perfect item in your online store but having no means to pay for it because you don’t accept their preferred method of payment. That’s a lost sale, and potentially a lost customer – someone who might not return due to this single disappointing experience.

However, adopting a variety of payment solutions is about more than avoiding missed opportunities. It’s a signal to your customers that your business is in tune with the times, aware of the latest trends, and committed to making transactions as frictionless as possible. It tells them that you value their time, understand their needs, and are willing to adapt to make their experience better.

For small businesses, this flexibility can be a game-changer. It’s a way to stand out from the competition and cater to a wider audience. In a world where consumers value convenience and speed, businesses that provide an array of payment options are often perceived as more reliable, customer-friendly, and ahead of the curve.

Want to offer more payment methods at checkout? We can help!

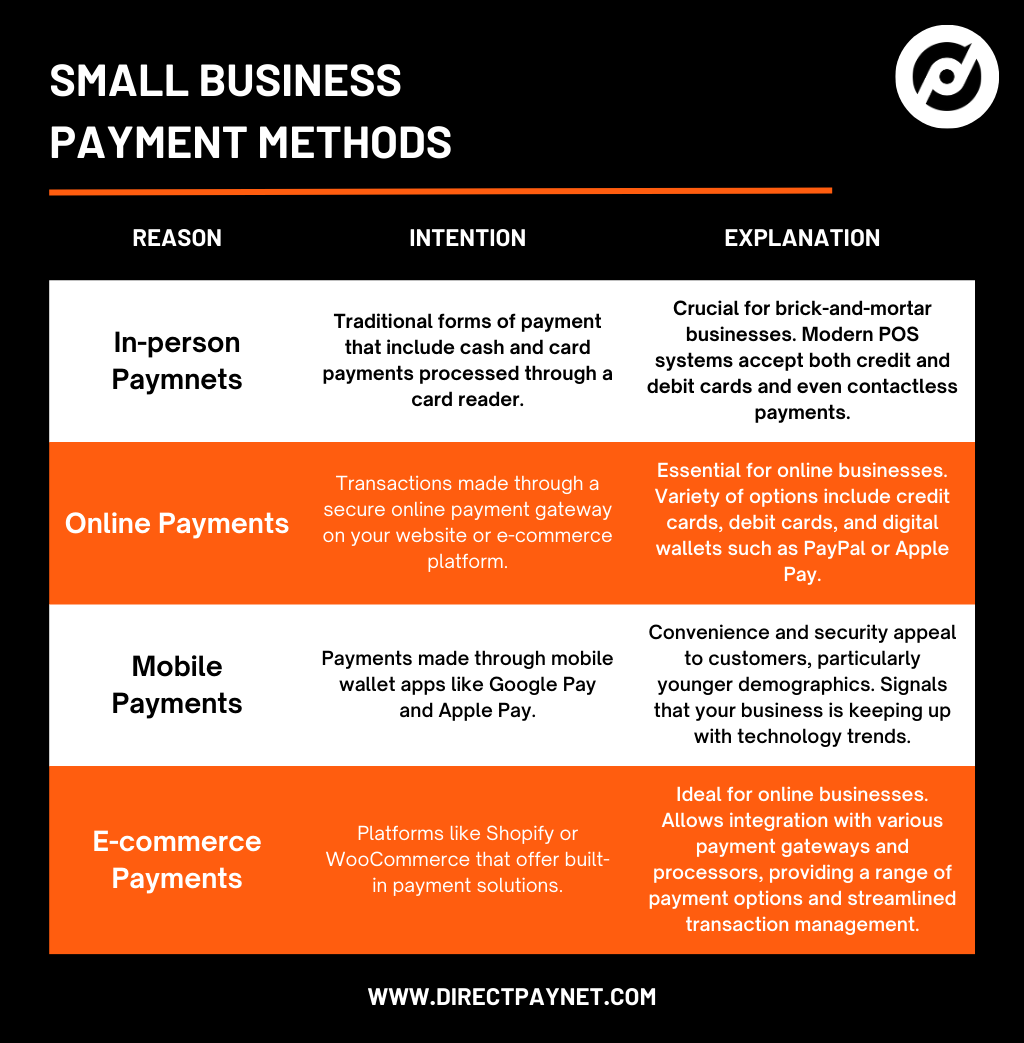

Small Business Payment Methods

Understanding the nuances of each option can help you choose the ones that best fit your business and customer base.

In-person Payments

The most traditional forms of payment include card and cash payments processed through a card reader. For brick-and-mortar businesses, it’s essential to have a reliable point-of-sale device (POS) that accepts both credit and debit card payments (Visa, Mastercard, American Express, Discover).

Modern POS systems even accept NFC contactless payments, which have soared in popularity due to their convenience and security.

Online Payments

Offering a secure online payment gateway is critical to inspire confidence in your customers. Two key elements in this are a smooth checkout process and a variety of payment options, including credit cards, debit cards, ACH, and digital wallets such as PayPal or Venmo.

Remember, the easier it is for a customer to part with their money, the more likely they are to do so.

Mobile Payments

The future is increasingly mobile, and the world of payments is no exception. Digital wallet apps like Google Pay and Apple Pay allow customers to store their payment information securely and make digital payments with a simple tap of their phone.

Offering this option signals that you’re not just keeping up with the times, but actively embracing the future.

Other Payments

For small businesses operating in the digital space, e-commerce platforms like Shopify or WooCommerce offer built-in payment solutions. They typically integrate with various payment gateways and processors, giving your customers a range of payment options and providing you with a streamlined system to manage your transactions.

There’s also the popular PSP services, like Stripe and Square. Though, these come with their own risks and limitations.

Comparing the different categories of small business payment methods

The Role of Payment Processing in Small Business Operations

Understanding how money moves from your customer’s wallet to your business bank account is crucial in the grand scheme of your operations.

At its core, payment processing is the handling of transactions when customers make purchases. Whether the transaction is made in person or online, the process generally involves a payment gateway, a payment processor, and the customer’s bank. Each player has a role in ensuring the transaction is successful, and understanding these roles can help you make better decisions for your online business.

Here’s how it usually goes: When a customer decides to make a purchase, they provide their payment information (via card reader or online form). This information is then securely transmitted via a payment gateway to the payment processor. The processor communicates with the customer’s bank to check if sufficient funds are available. If they are, the bank approves the transaction, and the funds are transferred to the merchant’s account.

At first glance, it seems straightforward, but it’s worth noting that each step can incur different fees. Transaction fees, setup fees, and monthly fees are common, as are processing fees, which can vary depending on your chosen payment processor and the types of payments you’re accepting.

The choice of payment processor is particularly crucial. It affects not just the cost of doing business, but the range of payment methods you can offer and the speed at which you receive your funds, impacting your cash flow.

Many processors also offer additional features like fraud protection, analytics, and integration with other business systems, all of which can streamline your operations. The key is finding a balance between cost and functionality that suits your particular business.

We know a thing or two about payment processing. Get in touch!

Key Considerations in Payment Method Selection

When choosing your small business payment methods, it’s not a simple case of picking the most popular options and calling it a day. Several factors need to be considered to ensure the chosen payment solutions align with your business needs and customer preferences.

Whichever you decide, it will reflect the quality and customer perception of your business.

Security and Compliance

In an era where data breaches are increasingly common, ensuring the security of your customers’ payment information should be a top priority. Your chosen payment processor must have PCI compliance, adhering to the standards set by the Payment Card Industry to protect cardholder data.

Additionally, features such as encryption, tokenization, and fraud protection can further bolster your security measures.

Processing Fees

Different processors have different fee structures. Some may charge a flat rate per card transaction, while others may take a percentage of each transaction. Additional fees can include monthly fees, setup fees, and chargeback fees.

Make sure to understand the entire fee structure before committing to a provider.

Multi-Currency Processing

If you’re selling to customers outside your home country, you may want to consider a processor that supports multi-currency payments. This not only simplifies the purchasing process for your international customers but also widens your customer base.

Integration

How well a payment method integrates with your existing systems is another essential consideration. An ideal payment solution should seamlessly integrate with your shopping cart, point-of-sale system, accounting software (e.g., QuickBooks), and other business systems.

This ensures a smooth transaction process, making life easier for both you and your customers.

User Experience

A smooth and straightforward checkout process reduces cart abandonment and enhances customer satisfaction. Look for a payment solution that offers a quick, easy, and streamlined checkout process.

Customer Support

Like any other service, having robust customer support from your payment service provider is vital. In the event of any issues with transactions, you want to be sure you can reach out to your provider promptly and receive the necessary assistance.

The most suitable payment method for your business will largely depend on the nature of your operations, your customer base, and your financial capacity. By carefully considering these factors, you can select payment solutions that not only streamline your transactions but also enhance your customers’ overall experience and, ultimately, your bottom line.

How to Optimize Your Payment Systems

So, you’ve selected a variety of payment methods that suit your business and customers’ needs – great! But the work doesn’t stop there. Optimizing these systems can ensure they work seamlessly and contribute positively to your business growth.

- Streamline the Process – The simpler your payment process, the better. A customer should be able to make a purchase with as few clicks or taps as possible, whether in-person or online.

- Keep Up with Trends – Pay attention to emerging payment technologies and trends. If a significant number of your customers start using a new payment service provider, consider adding that to your payment options.

- Provide Clear Information – Make sure your customers know what payment methods you accept. Display logos of accepted cards and digital wallets prominently at the checkout counter and on your website.

- Regular Reviews and Updates – This can help you identify and fix any issues before they affect your customers, keeping your operations smooth and efficient.

Your payment systems play a crucial role in customer experience, and hence, your business success. By continually optimizing them, you can ensure they serve your business effectively and keep your customers satisfied. It’s about creating an environment where customers don’t have to think twice before making a purchase – and that’s the ultimate goal, isn’t it?

Conclusion

Navigating the intricate landscape of payment methods and processing might seem daunting, but as we’ve explored, it’s an essential aspect of running a successful small business. The way you accept payments can significantly impact your customer experience, operational efficiency, and ultimately, your bottom line.

Choosing the right mix of payment methods, understanding the ins-and-outs of payment processing, and tackling potential challenges are all part of the journey. And while it might feel like a challenging task to take on, remember that you’re not alone in this journey.

As a small business owner, teaming up with an experienced merchant account provider like DirectPayNet can make a world of difference. We’ve guided countless business owners through the complexities of payment processing, particularly those in high-risk industries. With our expertise and support, you can set up a high-risk merchant account that meets your specific needs and allows you to transact with confidence.

Optimizing your payment systems might not be the most glamorous part of running a business, but its impact can be profound. Don’t let the complexity of the task deter you—take the first step today.

Reach out to our team at DirectPayNet, and let’s explore how we can improve your business’s credit card processing, together. Your customers, your team, and your future self will thank you for it.