Stripe is a widely used payment platform, servicing both large and small businesses globally.

But is it the right choice for all merchants? It depends on what you sell—and not only. Every online business is different, and with that comes varying needs. Let’s look at the pros and cons of Stripe, the types of businesses it’s good for, and more.

GET SECURE, RELIABLE PAYMENT PROCESSING

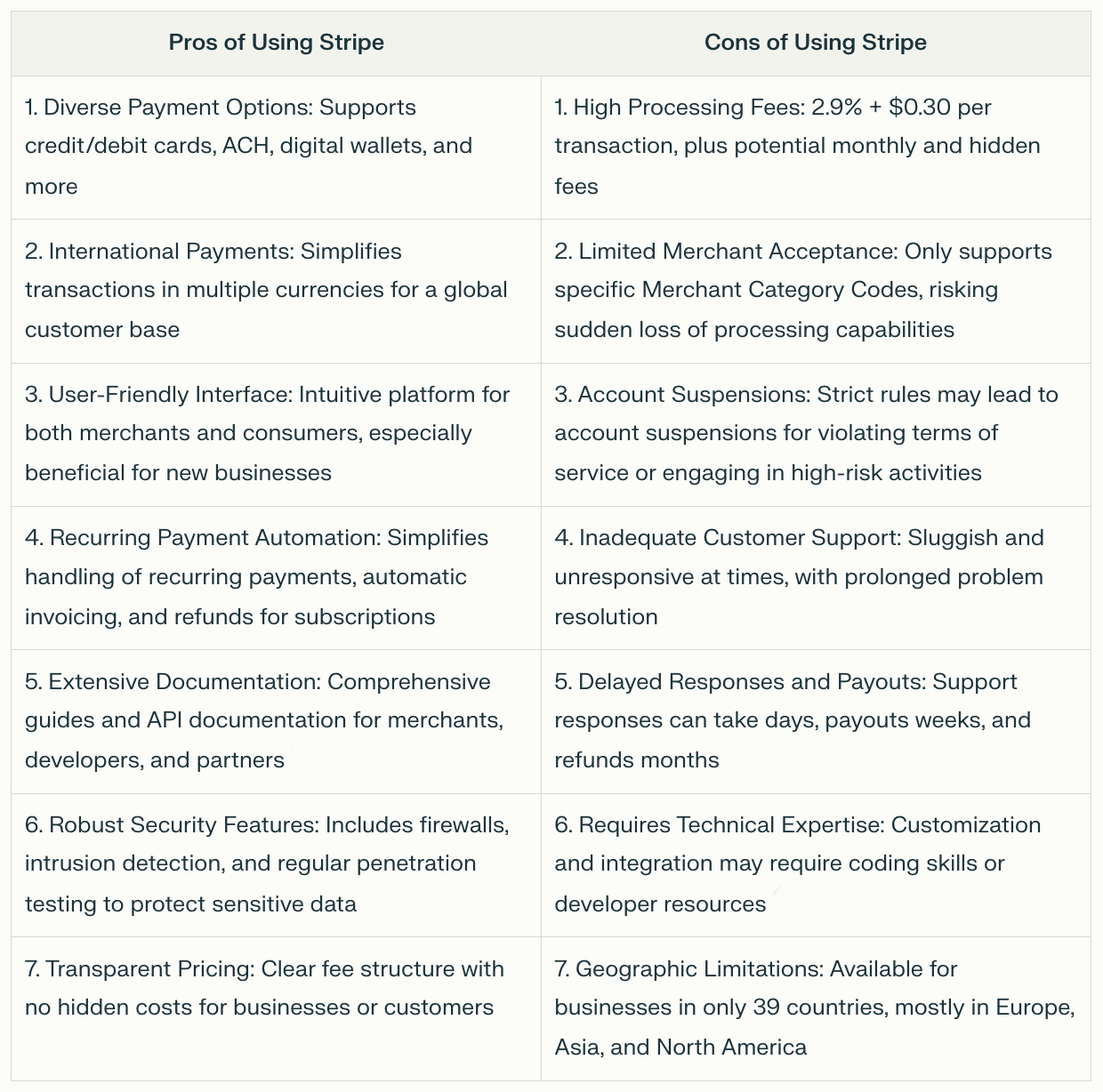

Pros of Using Stripe

Stripe offers many benefits to its customers. Here’s a list of the top Stripe pros.

- Quick Setup: With simple plans and a near 24-hour setup process, Stripe allows businesses to start accepting payments almost instantly.

- Diverse Payment Options: Stripe accepts a broad array of payment methods, including credit and debit cards (Visa, Mastercard, American Express, Discover), ACH, Apple Pay, Google Pay, and other digital wallets. This variety of payment types facilitates transactions from different customer segments, whether they prefer traditional or alternative payment methods.

- International Payments: With support for multiple currencies, Stripe simplifies international transactions, allowing businesses to cater to a global customer base effectively.

- User-Friendly Interface: Its user-friendly platform is intuitive for both merchants and consumers. New businesses find it particularly beneficial due to its ease of use in setup and integration. Customers are familiar with its minimal payment gateway at checkout.

- Recurring Payment Automation: The platform simplifies the handling of recurring credit card payments, offering automatic invoicing and refund options for subscription cancellations.

- Extensive Documentation: Stripe provides comprehensive guides and API documentation, assisting various users, including merchants, developers, and partners, in navigating and utilizing the platform efficiently.

- Robust Security Features: Includes firewalls, intrusion detection, and regular penetration testing to protect sensitive data.

- Transparent Pricing: Clear fee structure with no hidden costs for businesses or customers.

Cons of Using Stripe

As good as Stripe appears based on the above pros, it’s not without its cons. The service has some major flaws that you should pay attention to.

- High Processing Fees: With a 2.9% + $0.30 per transaction fee, as well as potential monthly fees and several hidden fees, costs can accumulate rapidly for businesses with a high volume of transactions.

- Limited Merchant Acceptance: Stripe supports only specific Merchant Category Codes (MCCs). If your business doesn’t fall under these codes, you risk losing your credit card processing capabilities without warning.

- Account Suspensions: Known for its stringent rules, Stripe may suspend accounts that violate their terms of service or engage in business activities deemed unsupported or high-risk.

- Inadequate Customer Support: Users have reported sluggish and sometimes unresponsive customer support, making problem resolution a prolonged process. Responses can take several business days, payouts can take weeks, and refunds can take months!

- Delayed Responses and Payouts: Support responses can take days, payouts weeks, and refunds months.

- Requires Technical Expertise: Customization and integration may require coding skills or developer resources.

- Geographic Limitations: Available for businesses in only 39 countries, mostly in Europe, Asia, and North America.

CONNECT WITH A PAYMENT SOLUTION THAT SUPPORTS YOUR BUSINESS

Is Stripe Safe?

This is a loaded question, and it really depends on what you sell or even how you sell it. Stripe may not be the safest payment processor for all online businesses due to its structure and policies.

Stripe is NOT a Merchant Account

Firstly, Stripe is not a true merchant account. It is what we call a third-party payment aggregator. This means that it pools together transactions from various businesses instead of providing each business with a unique merchant account.

While this makes the setup process faster and more straightforward, it also introduces a layer of risk. Without a dedicated merchant account, businesses may experience a lack of control and support, making their transactions more susceptible to interruptions and issues.

Frozen Funds and Suspended Accounts

Furthermore, Stripe has a history of freezing or terminating accounts with little to no notice if it detects activities that violate its terms of service or if it deems a business model high-risk.

Companies involved in selling supplements, coaching services, advice, tickets for travel or events, subscriptions and dropshipping are just a few that will face challenges with Stripe account suspensions.

Monthly Volume Trigger

For ecommerce business owners transacting below $20,000 per month and operating in low-risk categories, Stripe is safe.

However, as transaction volumes grow, the risks associated with account freezes and terminations increase. And what business doesn’t want to make more money? Stripe might be safe initially, but it quickly becomes a hazard.

Top Stripe Alternatives

When evaluating alternatives to Stripe, there are two main categories to consider: 3rd-party aggregators and dedicated merchant accounts. Each has distinct pros and cons that may make them a better fit for your business.

3rd-Party Aggregators

Payment aggregators like Stripe and PayPal offer a quick and easy way to start accepting payments without a lengthy application process. They pool many merchants together under a single master merchant account.

The biggest benefits are the fast sign-up process (often instant approval) and simple, flat-rate pricing. You can typically start processing transactions within a day or two. Popular 3rd-party aggregators include:

- Stripe

- PayPal

- Square

- Shopify Payments

- WooCommerce

However, aggregators also have significant downsides. They are only suitable for lower-volume businesses, as higher processing volumes can trigger account freezes or terminations. Their flat-rate pricing also tends to be more expensive than a dedicated merchant account as you cannot negotiate rates or remove unnecessary fees.

Merchant Accounts

A true merchant account provides you with your own dedicated account for payment processing rather than lumping you in with other merchants.

While the application process takes longer (often 1-2 weeks), a merchant account offers several advantages:

- Lower processing rates, especially as your volume grows

- Support for a wider range of business types, including high-risk

- Higher monthly processing limits without risk of sudden termination

- Ability to negotiate custom rates and terms as your business scales

Merchant account and merchant service providers worth considering include:

- DirectPayNet

- PaymentCloud

- Helcim

- Host Merchant Services

- Clearly Payments

TL;DR

3rd-party aggregators offer speed and simplicity in exchange for higher fees and the risk of account holds.

True merchant accounts take more effort to set up but provide better rates, account stability, and room for growth.

The right choice depends on your business model, size, and risk profile. And you can choose both! It is often best to start out with a 3rd-party aggregator like Stripe for startups or if you have no processing history and need to start accepting online payments.

It’s also a good idea to keep Stripe as a backup processor, emergency processor, or one that you can route low-risk transactions through.

You can do all of this while using a dedicated merchant account as your main processor, and then get the best of both worlds.