Spy Merchants: Why Payment Processors Decline Surveillance Products

Feb 13, 2020 8-MINUTE READ

Spy merchants are cashing in on the surveillance market in a big way.

This consumer retail category is growing into a multibillion-dollar industry. In fact, it’s forecasted to almost double its worth by the year 2023 to $68.3 billion. These are great projections. But spy merchants are not as sought after by some payment providers. Even though consumers around the world are demanding surveillance merchandise.

High-risk categories like this face trouble getting approved for payment processing. We’re not only talking about traditional surveillance technology. Eyeglasses with hidden cameras don’t sit well with acquiring banks. Neither do audio recording pens and night vision cameras. Mobile monitoring apps are also a big liability.

In short, if you’re a spy merchant then your business model is problematic. Consumer products in this retail group pose privacy concerns . Also, banks are worried about the legal implications associated with incidents where people may be unaware they are being tracked or monitored.

Despite these hurdles, there are a few payment providers still accepting spy merchants. But, approval is easier if you can present your business from a certain angle. Consider our recommendations below. They will increase your chances of success when applying for a merchant account.

Get to know General Data Protection Regulation and similar laws

Spy merchants must become familiar with laws in their respective regions to protect themselves. Court systems in North America and the UK are waiting for relevant legislation to be formulated. In Europe, privacy laws and regulations such as General Data Protection Regulation (GDPR) have made things harder for spy merchants to operate.

Many of these products and services may be viewed as defiant of the standards set forth for privacy by the EU legislation. Get a full understanding of the impact of GDPR on your business here.

Additionally, the US was under fire in the past couple of years for their controversial laws around whether spying may be considered legal. This raised serious questions. Namely, whether the actions that consumers take with products, such as spy cameras, can make a merchant somewhat accountable.

In Canada as well, there are still no firm surveillance camera and spyware laws. It’s fair game. According to The Canadian Internet Policy and Public Interest Clinic:

Canada does not have legislation that specifically targets spyware. However, federal and provincial laws that protect privacy and prohibit fraud, misleading representation, and other unfair trade practices, apply to those practices when deployed in spyware.

Stay on top of legislative changes within your industry

As you can see, there are ambiguous policies on consumer surveillance around the world. Due to lack of clarity, payment processors shy away from industries where the laws are not clear. As laws can be added or updated, acquiring banks are worried about being on the wrong side of the law when government adds legislation to a specific industry. So, to make things simpler, many payment providers decline industries where legalities can be misconstrued.

Almost every move you make is crucial to leading your business towards success. Compliance is the best avenue to get a high risk merchant account. Ensure your website displays clear product pricing, terms and conditions, and a rock solid privacy policy. All spy merchants should have very detailed product descriptions. They should be clear about how the product can be used and not invite consumers to break any laws.

If you operate in the surveillance industry stay abreast of updates and which new laws are being passed. You need to be aware of any legal implications that might affect your bottom line. This way you prevent your brand from coming under fire from activists and legal representatives.

Perception is key, ensure your product is presenting a legal use

Operating as a spy merchant brings much reputational risk. Make the best first impression when presenting your company. It will make a difference to the acquiring banks and merchant service providers reviewing your online business.

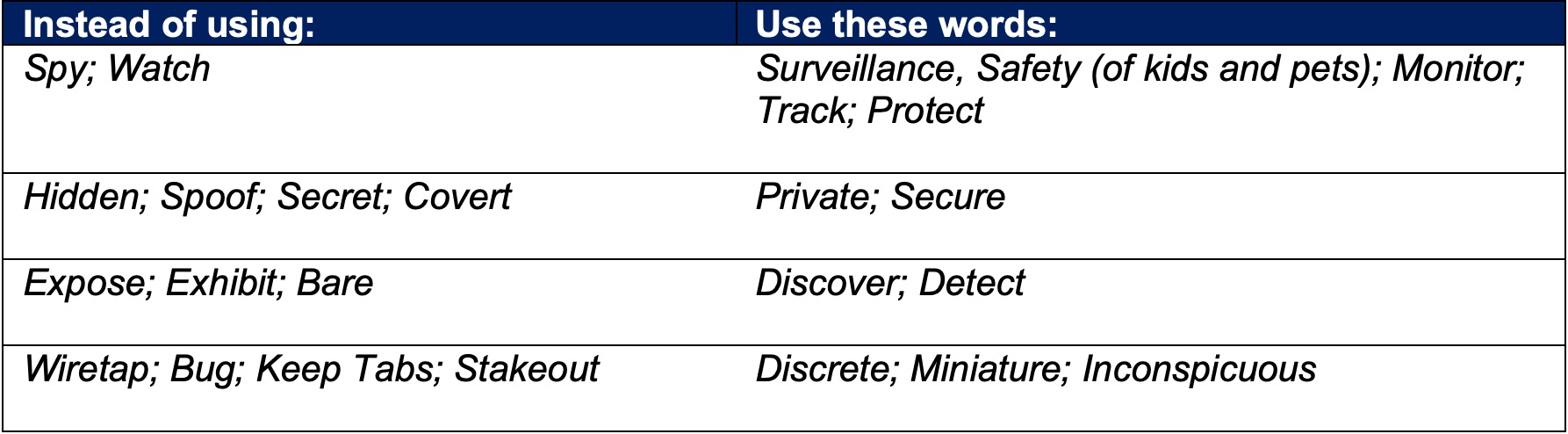

When products are focused around being “hidden” or “secretive” it leads banks to believe you promoting illegal or dodgy behavior. The word “spy” in itself automatically has a negative connotation. This is a hassle account to most processors.

Try changing or adjusting to certain buzzwords within your content. It will change how banks interpret your brand. For example:

It’s more helpful to use an image of trust and legality rather than promoting your product as a privacy concern. Banks are far more likely to trust the business of your brand if your customers are average people wanting to protect their property and family. Some employers use monitoring software products to track employees. Therefore, it’s important to find a legal business case for your product.

Present your products as being anti-spy and you may gain an advantage. For example, introduce surveillance and software items as a means to detect and protect against other malicious threats. This will be better seen as a solution instead of an addition to the problem.

There are examples online of many surveillance brands choosing the keyword “spy”. This is opening the door wide open to less than flattering customers. (Don’t worry, we’re not judging.)

Yet, their payment processing abilities could be faltered or controversial. They could be paying huge fees or have processing restrictions on their end like a 20% rolling reserve and a security balance.

Find an experienced advisor or consultant to help you get a high-risk merchant account. DirectPayNet can negotiate the best rates and develop a plan once you’ve established processing history. Click here to learn more about our services.

Prepare for high fees and substantial processing history

Acquiring banks know that surveillance, tracking and monitoring products might compromise a consumer’s security in the wrong hands. Given this concern, they want as little liability as possible. They may take a few extra measures before agreeing to work with you. That includes the terms of your merchant account.

Don’t be surprised if your spy retail business is charged higher merchant pricing. Your product is not low risk. If it was, services from Paypal or Stripe might be willing to accept this type of business. There’s greater liability for your product or service should there be any claims of misuse from the public. Unsurprisingly, an increase in discount rates, chargeback fees and other pricing may occur. An acquiring bank or payment provider will want to cover potential legal liabilities if there is an issue pertaining to the use of your spy product or service.

Additionally, clean processing history is a must for your company to show the volume of your transactions, monthly sales and chargebacks. You should have account statements for at least your last three months of transaction history. Good monthly performance and low fraud will help convince a payment provider to work with you.

We know. For many, this is difficult to do if you’re a startup. In this case, you may have to be flexible and agree to even stricter terms. For example, a 20% rolling reserve and a security balance at least in the beginning in order to prove yourself.

Reduce risk by incorporating anti-fraud measures

Some payment and service providers think that spy merchants and fraud are synonymous. This doesn’t have to be the case. There are anti-fraud measures you can maximize to reduce risk and build a good reputation with acquiring banks.

Develop a plan of action that builds trust with customers. This approach coupled with fraud and chargeback prevention efforts greatly aids in lowering risk.

-

Establish a strong customer support network.

Does your business has several complaints on review websites with no response? Do you have a bad grade on the Better Business Bureau (BBB) website? During the merchant account approval process acquiring banks and payment providers investigate applicants. They examine previous processing history (as discussed above). Additionally, they check your reputation online. If their findings are negative, it may make approval for payment processing difficult.

Buyers should be able to reach you within a reasonable time frame. So, have your contact information on your website. Plus, make sure support agents reply to customers within one business day or faster. This will help curb online complaints and chargebacks.

-

Adhere to PCI DSS compliance.

Many brands are quick to push monitoring software and tracking products to market. Yet they do so without testing the safety and security of its inner workings or their actual website. Think of it this way. Staff members with bad motives can compromise the integrity of your product and your payment process. Thus, outside fraudsters more experienced in targeting unsuspecting businesses will unearth it even quicker. Ensure your site has the appropriate SSL certificate and encryption. To understand more about PCI compliance, go here.

-

Prevent and manage fraud.

You can promote a quicker and healthier processing history through machine learning. Use third-party analytical tools to prevent fraudulent orders from occurring. Use anti-fraud controls at your shopping cart or CRM and gateway level to set appropriate rules. For example, block high-risk countries prone to fraud. Flag or block customers that have previously requested refunds or chargebacks.

Also, implement smart authentication tools like PSD2 and 3DS2 in your checkout. In conclusion, there are plenty of sophisticated AI and machine learning software out there. Integrate them into your web platform and mobile app structure to protect your bottom line. It will prove to card networks that you’re covering all your bases.

The spy and surveillance industry keeps growing in popularity and in revenue. Many drawbacks of operating in a high-risk industry can become mute, particularly if you’re raking in big dollars and keeping fraud low.

We recommend staying up to date on the latest legislation and legal implications of working within consumer-controlled tracking and monitory. This can help prevent any future mishaps or misunderstandings. Of course, this also goes hand-in-hand with the image your brand portrays and the words you use to describe your products and services.

We hope you can succeed with our techniques and advice. Limit the chances of misinterpretation by acquiring banks. Or prepare to get slapped with high fees. It’s all about strategy and planning your online spy business with the best foot forward. It is possible to get a merchant account for these types of products. You just need to be strategic in the way you showcase your business.