Not all businesses are treated equally by payment processors. High-risk businesses are subjected to stricter monitoring due to the higher risk of chargebacks and fraud. But not every merchant knows if they’re high risk or not.

If your Stripe account was recently terminated or your merchant account application has been repeated denied, it’s because you are high risk.

The solution? High-risk payment processors. But you can’t just sign up with a processor. First, you need a merchant account to connect you with one. That’s where high-risk merchant accounts come in.

High-risk merchant accounts provide industry-specific merchant services to high-risk businesses that help minimize risk and ensure a working payment gateway.

Why are some businesses considered high-risk? What do they sell that label them as such? And what exactly do high-risk merchant accounts provide their clients? Read on for a breakdown of what makes a business high-risk and how you can minimize fees and maximize profit if you’re labeled as one.

What is a High-Risk Merchant Account?

If you’re in the e-commerce space, you’ve likely come across the term ‘high-risk merchant account.’ But what does this mean, and how does it differ from a typical, or ‘low-risk,’ merchant account?

In simple terms, a high-risk merchant account is a payment processing account for businesses considered as ‘high-risk’ by credit card processors or banks. These businesses often operate in industries that, for various reasons, carry a higher level of risk. These risks could range from a high likelihood of chargebacks and fraud to legal issues and reputational concerns.

What’s the difference between high-risk and low-risk merchant accounts?

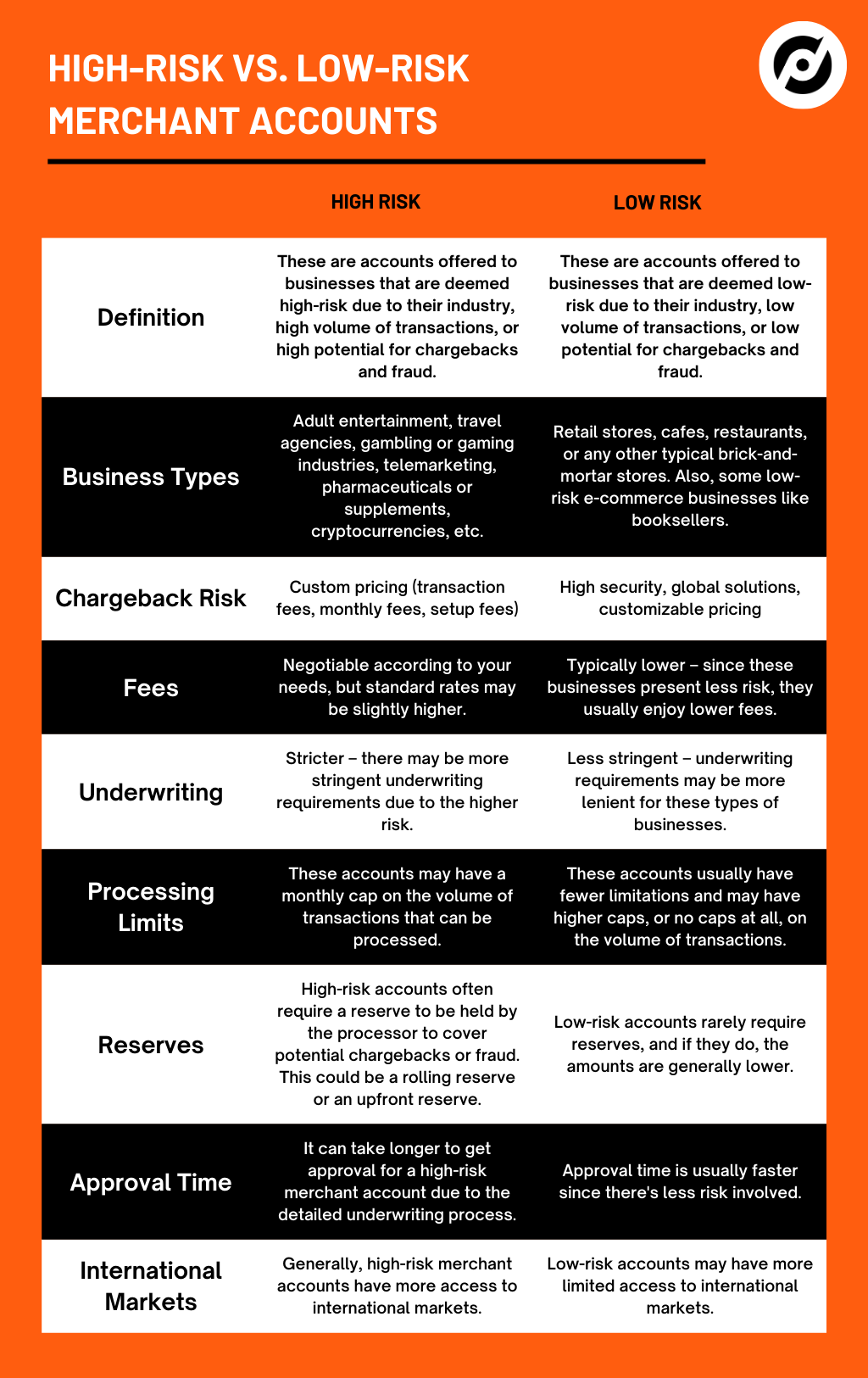

Now, you might be wondering, “What makes a merchant account ‘high-risk’ compared to ‘low-risk’?” The distinction lies in the perceived risk associated with the business. Low-risk merchant accounts are typically given to businesses in industries with low chargeback ratios, stable business sectors, and operate in low-risk countries. They also usually have a smaller average ticket size.

In contrast, high-risk merchant accounts are often assigned to businesses with high chargeback ratios or operate in unstable business sectors. They may also cater to global markets, have a larger average ticket size, or provide products or services prone to fraud or legal complications.

Who are High-Risk Merchant Accounts for?

Now that we have a better understanding of what high-risk merchant accounts are, the question arises: who exactly needs these accounts? The answer lies in the type of business and the industry in which it operates.

High-risk merchant accounts are typically needed by businesses that operate in industries considered risky by banks and payment processors.

Here are some examples of businesses that may need a high-risk merchant account:

- Adult Entertainment: Due to its controversial nature and the potential for legal complications, the adult entertainment industry is often categorized as high-risk.

- Travel and Tourism: This industry faces high chargeback rates due to cancellations and the often high-ticket cost of bookings.

- E-commerce: Online stores, particularly those selling high-value goods or serving customers internationally, can be considered high-risk due to potential fraud from card-not-present transactions.

- Gaming and Online Gambling: These industries face legal restrictions in many jurisdictions, making them high-risk.

- Telemarketing and Direct Sales: These businesses often have high chargeback rates and face reputational risks.

- Pharmaceuticals, Nutraceuticals, and Supplements: e.g., weight loss and CBD. Legal restrictions, safety concerns, and high chargeback rates make this sector high-risk.

These are just a few examples, and many other types of businesses could fall into the high-risk category, such as dropshipping, e-cigarettes and vapes, multi-level marketing (MLM), psychic readings, digital products, timeshares, and services.

Sometimes, it’s not even the product that you sell or your business type. High-volume merchants, those who have had excessive chargebacks, no processing history, bad credit, or are simply new businesses/startups also fall under high-risk.

If your business falls under any of these categories, or if it’s simply prone to high chargebacks or operates globally, a high-risk merchant account could be a lifeline for your operations.

The Role of High-Risk Credit Card Processing in Online Commerce

In our increasingly digital world, credit card transactions have become the norm for online commerce. This is no different for high-risk businesses, but the process and implications are somewhat unique. High-risk credit card processing plays a vital role in allowing these businesses to operate smoothly and efficiently in the online marketplace.

The primary role of high-risk credit card processing is to enable businesses in high-risk industries to accept credit card payments securely and effectively. Without this service, businesses may face significant challenges in accepting payments, which can impact sales and customer satisfaction negatively.

The way high-risk credit card processing works is quite simple. A customer makes a purchase on your website and pays using their credit card. This payment is then processed through your high-risk merchant account. The funds are held by the payment processor for a short period, after which they are transferred to your small business account.

While high-risk credit card processing shares many similarities with traditional processing, the high-risk status does influence a few key factors:

- Costs: High-risk businesses typically face higher fees compared to low-risk businesses. This is due to the elevated risk associated with their operations. Fees can include higher transaction fees, setup fees, and monthly fees.

- Reserve requirements: Some high-risk payment processors may require a rolling reserve to cover potential chargebacks or fraud. This is a percentage of the processed amount that is held for a certain period before being released to the merchant.

- Risk mitigation measures: High-risk credit card processing companies often have robust measures in place to detect and prevent fraud. This can include advanced fraud detection tools and stricter security protocols.

Using Stripe or PayPal? Don’t put your business for any longer!

High-Risk Merchant Services and What They Offer

High-risk merchant services go beyond providing a platform for credit card processing. They offer a comprehensive suite of services designed to help high-risk businesses navigate the complexities of their industries, mitigate risks, and maximize profitability. These services are often tailored to the unique needs and challenges faced by high-risk businesses. Here’s an overview of what high-risk merchant services typically offer:

- Payment Processing Solutions: The core offering is, of course, the ability to process payments, including credit and debit card transactions. High-risk merchant services also often support a range of other payment methods, such as eChecks and mobile payments, to meet the diverse needs of their clients.

- Fraud Prevention and Security: High-risk merchant service providers often have advanced security measures to protect sensitive data and prevent fraudulent activities. These can include encryption, tokenization, and fraud management tools that help identify and prevent suspicious transactions.

- Chargeback Management: Chargebacks are a significant concern for high-risk businesses. High-risk merchant services often offer chargeback prevention and management tools to help businesses reduce their chargeback ratios. This can include services like chargeback alerts and dispute management assistance.

- Multi-Currency Support: Many high-risk businesses operate globally, and having the ability to accept payments in multiple currencies is crucial. High-risk merchant service providers often offer multi-currency support, allowing businesses to serve a global customer base effectively.

- Reporting and Analytics: Data is key to making informed decisions in business. High-risk merchant services typically provide robust reporting and analytics tools to help businesses track sales, identify trends, and monitor their performance.

- Customer Support: The complexities of high-risk payment processing require expert assistance. High-risk merchant service providers typically offer round-the-clock customer support to ensure businesses can resolve any issues promptly.

Above all, high-risk payment service providers help you avoid the MATCH list or the TMF (terminated merchant file).

As you can see, high-risk merchant services offer a comprehensive solution for high-risk businesses to manage their payment processing needs effectively. They’re not just about processing transactions; they’re about providing the tools and support businesses need to navigate the high-risk industry successfully.

Choosing the Right High-Risk Payment Gateway

A payment gateway plays a crucial role in processing online transactions. For high-risk businesses, choosing a reliable high-risk payment gateway is a key decision that can significantly impact their operations and customer experience.

But what is a payment gateway? In simple terms, it’s a technology that securely transmits the payment information from your website to the payment processor for authorization and finally to your bank account.

When choosing a high-risk payment gateway, you should consider several factors to ensure it meets your business needs and industry regulations. Here are some considerations:

- Security: The payment gateway should have robust security measures to protect sensitive data and reduce the risk of fraud. Look for gateways that support encryption, tokenization, and have PCI-DSS compliance.

- Compatibility: The payment gateway should integrate seamlessly with your e-commerce platform. It should also work well with other systems you use, such as your CRM or accounting software.

- Support for Multiple Payment Methods: Your payment gateway should support all the payment methods that your customers prefer to use. This can include credit and debit cards, eChecks, ACH, mobile payments, and even digital currencies.

- Multi-Currency and International Support: If you operate globally, your payment gateway should support multiple currencies and international transactions.

- Customer Support: Having access to responsive and knowledgeable customer support is crucial. You need to be able to resolve any issues quickly to maintain smooth operations.

- Pricing: Consider the fees associated with the payment gateway. This includes transaction fees, setup fees, and any monthly fees. While high-risk gateways may have higher fees, they should still be reasonable and competitive.

Remember, the right payment gateway for your high-risk business is the one that meets your unique needs and provides a smooth, secure payment experience for your customers. It’s worth taking the time to research and compare different options before making your decision.

Need high-risk payment processing for your online business?

No matter what sector you operate in, it’s clear that having a reliable high-risk merchant account is an invaluable asset to any online business owner.

At DirectPayNet, we specialize in providing customized high-risk merchant solutions designed to meet your unique needs. As a reputable high-risk merchant account provider and with our robust high-risk payment gateway, advanced fraud prevention tools, and unparalleled customer service, we can help your business navigate the complexities of high-risk payment processing.

Take the next step in empowering your high-risk business. Contact DirectPayNet today to open your high-risk merchant account and unlock a world of opportunities for your business. Let’s face the challenges of high-risk payment processing together and pave the way for your business’s success.