5 Ways to Reach Below 5% Refund Rate & Avoid Chargeback Scams

May 6, 2024 4 minutes

Chargeback scams are an increasingly significant threat to the bottom line of ecommerce businesses, particularly those operating in high-risk industries. These fraudulent chargebacks not only result in lost revenue but also lead to increased operational costs, damaged relationships with payment processors or service providers, and potential penalties from card networks like Visa and Mastercard.

Here’s how to prevent chargeback scams and 5 ways to lower your refund rate.

Your high-risk business needs a better payment processor. We can help!

What is a Chargeback Scam?

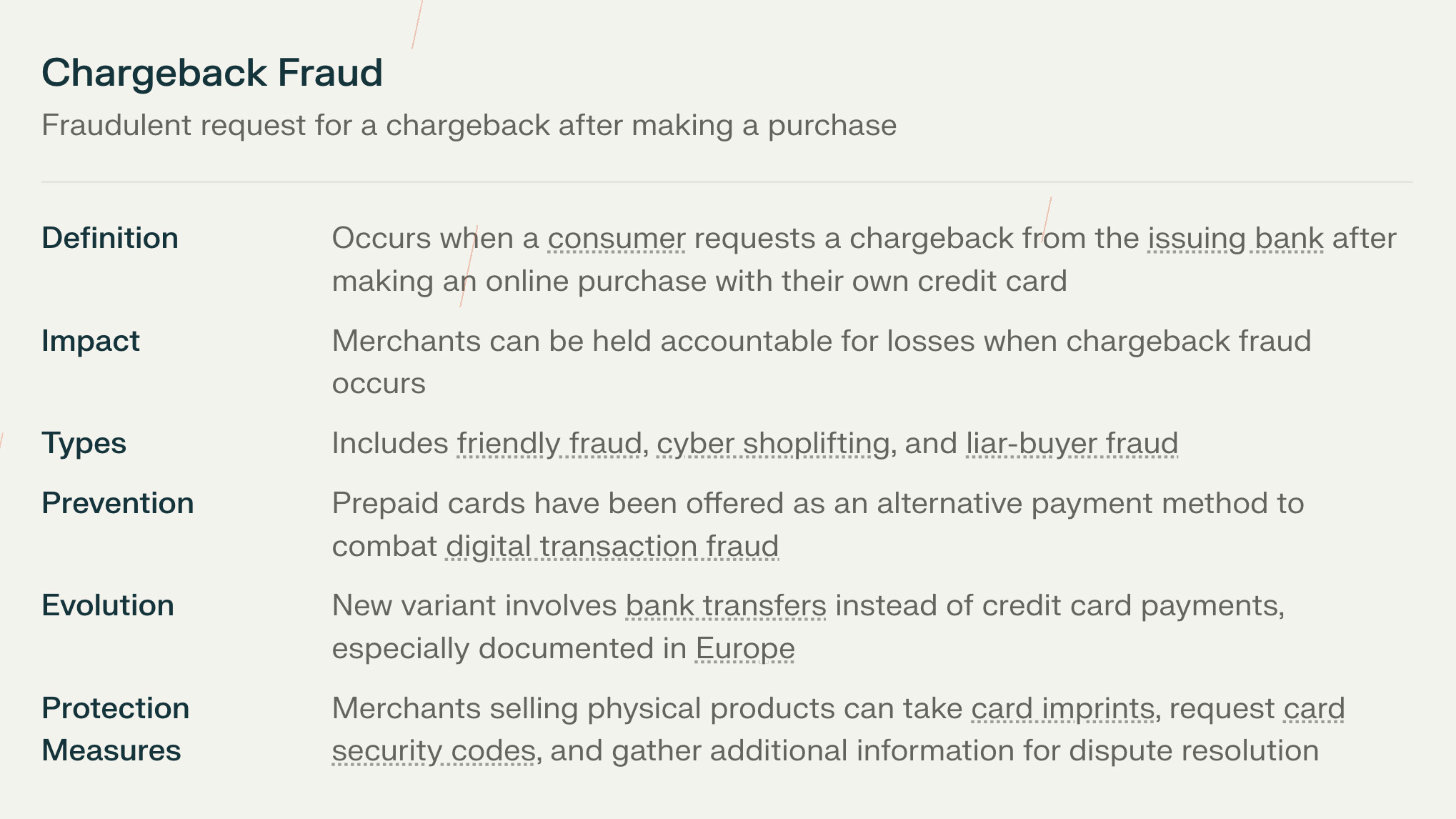

Table of chargeback scams.

A chargeback scam, also known as chargeback fraud, occurs when a customer intentionally disputes a legitimate credit card charge to receive a refund while keeping the purchased product or service. In essence, the customer exploits the chargeback process designed to protect consumers from fraudulent transactions, using it as a tool to commit fraud against merchants.

Customers contact their issuing bank, the card issuer, for chargeback claims. You’ll be know when you’re hit with a chargeback not from the customer, but from the bank or processor.

There are several types of chargeback fraud, including:

- Friendly fraud: This happens when a customer disputes a legitimate card transaction, claiming they didn’t authorize it, didn’t receive the item, or that the product was defective. The key difference between friendly fraud and other types of chargeback fraud is the lack of malicious intent, as it often results from an honest mistake or misunderstanding.

- First-party fraud: In this case, the cardholder deliberately initiates a chargeback on a legitimate purchase with the intent to defraud the merchant. They may falsely claim that they never received the item or that it was defective, all while keeping the product or service.

- Third-party fraud: This type of chargeback fraud involves the use of stolen credit card information to make unauthorized purchases. The actual cardholder then disputes the charges, resulting in a chargeback.

Chargebacks are often worse than refunds for merchants because:

They involve additional chargeback fees, potential penalties from credit card companies, and a time-consuming dispute process. Moreover, excessive chargebacks can lead to higher processing fees, the termination of merchant accounts, and even the inability to accept certain credit cards.

Bad refund or return policies can contribute to chargeback scams by making it difficult for customers to resolve issues directly with the merchant. When customers face obstacles in obtaining a refund or returning a product, they may resort to filing a chargeback instead.

There are many tools to monitor for fraud detection and chargeback management. If you need help finding one, get in touch with our team and we can help.

Suffering from high chargebacks? We can help!

The Target Refund Rate for Ecommerce Businesses

As an ecommerce business owner, it’s crucial to monitor and manage your refund rate to ensure the long-term success and profitability of your venture. While it’s impossible to eliminate refunds and returns entirely, setting a target refund rate can help you gauge your performance and identify areas for improvement.

The ideal refund rate for online businesses should be below 5%:

With a rate of around 3% or less being the most desirable. This target strikes a balance between providing excellent customer service and maintaining a healthy bottom line. Ecommerce stores typically see a return rate of 18.1%, compared to 8-10% for physical stores, so aiming for a refund rate below 5% is a realistic and achievable goal.

It’s important to recognize that a 0% refund rate is not a realistic target for any business. There will always be instances where customers need to return products due to factors such as incorrect sizing, product defects, or mismatched expectations. Striving for a 0% refund rate can lead to overly strict policies that ultimately harm customer satisfaction and loyalty.

High refund rates can have a significant impact on your business, affecting both your revenue and reputation. Excessive refunds can lead to reduced profits, increased operational costs, and strained relationships with credit card payment processors and card networks. Moreover, a high refund rate may indicate underlying issues with product quality, website information, or customer service that need to be addressed to prevent future returns and maintain customer trust.

Causes of High Refund Rates and Chargebacks

High refund rates and chargebacks can be attributed to various factors, ranging from poor business practices to customer misconceptions. You should aim to understand the root causes of these issues to effectively address them and protect your business. Let’s explore some of the primary reasons behind high refund rates and chargebacks.

1. Poor Refund Policies

Overly strict or complicated refund policies can frustrate customers and lead to increased chargeback disputes. If customers find it challenging to obtain a refund or return a product through proper channels, they may resort to filing a chargeback with their debit or credit card company.

To avoid this, implement clear, fair, and easily accessible refund policies that prioritize customer satisfaction.

2. Inadequate Pricing Strategies

Pricing discrepancies or hidden fees can catch customers off guard and lead to dissatisfaction. If a customer feels misled about the total cost of a product or service, they may request a refund or initiate a chargeback.

Be transparent about pricing, including any additional fees or charges, and ensure that your pricing strategies align with customer expectations.

3. Subpar Customer Service

Poor customer service can exacerbate issues and drive customers to seek refunds or file chargebacks. If customers feel ignored, dismissed, or unable to resolve their concerns through your customer support channels, they may turn to their credit card company for assistance.

Invest in training your customer service team, establish clear communication guidelines, and prioritize prompt and effective issue resolution.

4. Unclear Product Descriptions or Checkout Process

Inaccurate or incomplete product descriptions and a confusing checkout process can lead to customer dissatisfaction and increased refund requests. If customers receive products that don’t match their expectations or encounter difficulties during the purchasing process, they may feel misled and seek a refund.

Ensure that your product descriptions are detailed, accurate, and include all relevant information. Streamline your checkout process to minimize confusion and provide a seamless user experience.

High refunds lead to less secure payment processing. Let’s fix it.

5 Strategies to Reduce Refund Rates and Prevent Chargeback Fraud

Now to the meat of the post. Here are five effective ways to stop fraudsters in their tracks and reach that 5% refund rate.

1. Implement Easy Cancellation Processes

If your business operates on a subscription model, make it simple for customers to cancel their subscriptions when needed. Offer one-click cancellations and allow customers to cancel through the same method they used to subscribe, such as your website or by phone.

By removing barriers to cancellation, you reduce the likelihood of customers filing chargebacks out of frustration or confusion. This is also an opportunity to promote a different product, offer a discount, or send an affiliate link to a competing product.

Make cancellations a sales funnel, not a loss!

2. Optimize the Checkout Process

Ensure that your checkout process is clear, informative, user-friendly, and secure. Use 3DS2 for identity verification, provide a complete credit card form, and ensure there’s at least one measure of authentication. The more data obtained, the better. Even though there may be more fields for a customer to fill, it will help reduce the number of chargebacks you receive and prevent bad actors from acting out.

Also provide customers with all the necessary details about their order, including when they can expect to receive their product, how it will be shipped, how to access digital products, and how the charge will appear on their credit card statement.

By setting accurate expectations and minimizing surprises, you can reduce the risk of refunds and chargebacks.

3. Prioritize Fulfillment Within the US

Whenever possible, fulfill orders from within the United States. Domestic fulfillment tends to be more reliable in terms of delivery speed and product quality compared to international shipping.

By reducing the likelihood of delayed or damaged shipments, you minimize the risk of customer dissatisfaction and subsequent refund requests or chargebacks.

4. Utilize Decision Trees for Customer Service Teams

Equip your customer service representatives with decision trees that guide them through various scenarios and provide appropriate responses. This approach ensures consistency in handling customer inquiries and complaints, reducing the chances of miscommunication or inadequate solutions that could lead to refunds or chargebacks.

Regularly update and refine your decision trees based on customer feedback and emerging trends. Using one prevents customer service reps from leaving customers hanging, proposing the wrong solution, or communicating poorly.

5. Review and Refine Copy — TOP METHOD TO REDUCE REFUNDS

This is a powerful fraud prevention tactic that is rarely considered. Carefully review and optimize your website copy, product descriptions, and marketing materials to ensure they accurately represent your offerings and set clear expectations for customers.

Avoid overpromising or using misleading language that could lead to customer disappointment or misunderstandings. In many industries, it is actually illegal to mislead customers. But even if your industry doesn’t fall into that, being too vague or leaving important details out will lead unhappy customers and chargebacks.

By providing transparent and precise information, you reduce the likelihood of refunds and chargebacks stemming from unmet expectations.

REDUCE REFUNDS AND CHARGEBACKS TODAY WITH A HIGH-RISK MERCHANT ACCOUNT

23 thoughts on “5 Ways to Reach Below 5% Refund Rate & Avoid Chargeback Scams”