What Is a Merchant Account and How Does It Work?

A merchant account serves as the agreement between your business, a merchant acquiring bank, and a payment processor for the settlement of card transactions. Think of it as a payment holding zone between your customer’s bank and yours.

Here is how funds flow every time a customer pays:

- Customer initiates payment — They swipe, tap, or enter card details in-store or online.

- Payment gateway transmits data — Your gateway securely routes the transaction to the payment processor.

- Processor routes to the card network — Visa, Mastercard, or another network receives the authorization request.

- Issuing bank approves or declines — The cardholder’s bank checks funds or credit and responds in real time.

- Funds are held in the merchant account — An approved transaction enters a temporary holding state.

- Settlement and deposit — After the settlement period, funds transfer to your primary business bank account.

The entire authorization happens in seconds. Settlement takes 1–3 business days. For a deeper look at every player in this process, see our Payments 101: A Complete Guide to Payment Processing.

Merchant Account vs. Payment Gateway: What’s the Difference?

This is one of the most common points of confusion. A payment gateway is software — it encrypts and transmits card data from your checkout to the acquiring bank. A merchant account is the actual account that holds and settles the funds. You need both: the gateway moves the data, the merchant account moves the money.

Some all-in-one processors bundle them together. Understanding the distinction matters when comparing merchant account providers, because the pricing, stability, and control you get from each component can vary significantly.

What Is a Merchant ID (MID)?

A Merchant ID (MID) is the unique identifier assigned to your business when you open a merchant account. Every transaction you process is tied to it. Your acquiring bank and processor use your MID to monitor transaction volume, chargeback ratios, and risk patterns over time.

If your MID is flagged for excessive chargebacks, suspicious activity, or fraud, your account can be frozen or terminated. In severe cases, your business may be added to the MATCH list — an industry blacklist maintained by Mastercard that makes it extremely difficult to get approved with another merchant account provider.

Protecting your MID means staying compliant, keeping chargebacks low, and being transparent with your processor about your business model from day one.

What Are Merchant Category Codes (MCCs)?

A Merchant Category Code (MCC) is a four-digit number assigned by card networks to classify what your business sells. There are MCCs for virtually every business type — retail, SaaS, supplements, travel, online coaching, gaming, and more.

Your MCC directly affects:

- Merchant account fees — Some categories carry higher interchange rates by default

- Approval odds — Platforms like Stripe and PayPal block certain MCCs outright

- Underwriting scrutiny — Higher-risk MCCs trigger deeper review

- Processing eligibility — Some processors won’t work with specific MCCs at all

Selecting the wrong MCC — intentionally or not — is one of the fastest ways to have your account shut down. See our full guide on how to choose the right MCC for your business.

Merchant Account Fees: What You’ll Actually Pay

Merchant account fees are one of the most misunderstood parts of payment processing. Most merchants focus on the headline rate and miss the full picture. Here’s what you’re actually paying for:

Interchange fees are set by the card networks (Visa, Mastercard, Amex, Discover) and paid to the issuing bank on every transaction. They form the baseline cost and vary by card type, transaction type (card-present vs. card-not-present), and MCC. These are non-negotiable.

Assessment fees are charged by the card networks themselves — a small percentage on top of interchange. Also non-negotiable.

Processor markup is what your merchant account provider charges on top of interchange and assessments. This is the negotiable part.

The Three Pricing Models

Interchange-plus pricing passes the actual interchange cost through to you, then adds a fixed markup (e.g., interchange + 0.30% + $0.10). This is the most transparent model and typically the best for higher-volume merchants.

Flat-rate pricing charges one fixed percentage for all transactions regardless of card type (e.g., 2.9% + $0.30). Simple, but can be expensive at scale because you don’t benefit when interchange is lower.

Tiered pricing groups transactions into qualified, mid-qualified, and non-qualified tiers with different rates for each. This model is the least transparent and often the most expensive.

Beyond those, watch for monthly minimum fees, setup fees, PCI compliance fees, chargeback fees, and early termination fees. Understanding your merchant account statement is essential to knowing whether you’re being overcharged. Our guide to reading your merchant statement and lowering processing fees walks through exactly what to look for.

High-Risk vs. Standard Merchant Accounts

Not every business qualifies for the same type of merchant account. The industry you operate in and the risk profile of your transactions determine whether you need a standard or high-risk account.

Standard Merchant Accounts

Standard accounts are designed for low-risk businesses — stable models, low chargeback rates, and industries that are straightforward to underwrite. Retail stores, restaurants, and professional service firms are common examples. Approval is faster, fees are lower, and reserves are rarely required.

High-Risk Merchant Accounts

High-risk merchant accounts serve industries with a higher likelihood of chargebacks, regulatory complexity, or fraud exposure. Common categories include adult entertainment, CBD and cannabis products, gambling and gaming, travel and timeshares, subscription services with recurring billing, and nutraceuticals.

Many merchants are surprised to discover their business is classified as high-risk. Even a legitimate, well-run online business can face increased scrutiny due to its product category, average ticket size, or refund patterns. High-risk approval takes longer and may come with higher fees and a rolling reserve — but it gives you processing that actually fits your business, rather than a fragile aggregator account that can be shut down without notice.

If you’re unsure whether your business is high-risk, or want to understand what that means for your options, see our full guide: What Is a High-Risk Merchant Account?

International and Offshore Merchant Accounts

For businesses processing internationally, or those that have been declined by domestic acquirers, an offshore merchant account may be worth exploring. Offshore accounts are issued by acquiring banks in other jurisdictions, which can unlock processing for industries or business models that domestic banks won’t touch. They typically come with higher fees and more complex compliance requirements, but they can be a viable path for the right business. Learn more about offshore merchant accounts and when they make sense.

Payment Aggregators vs. Dedicated Merchant Accounts

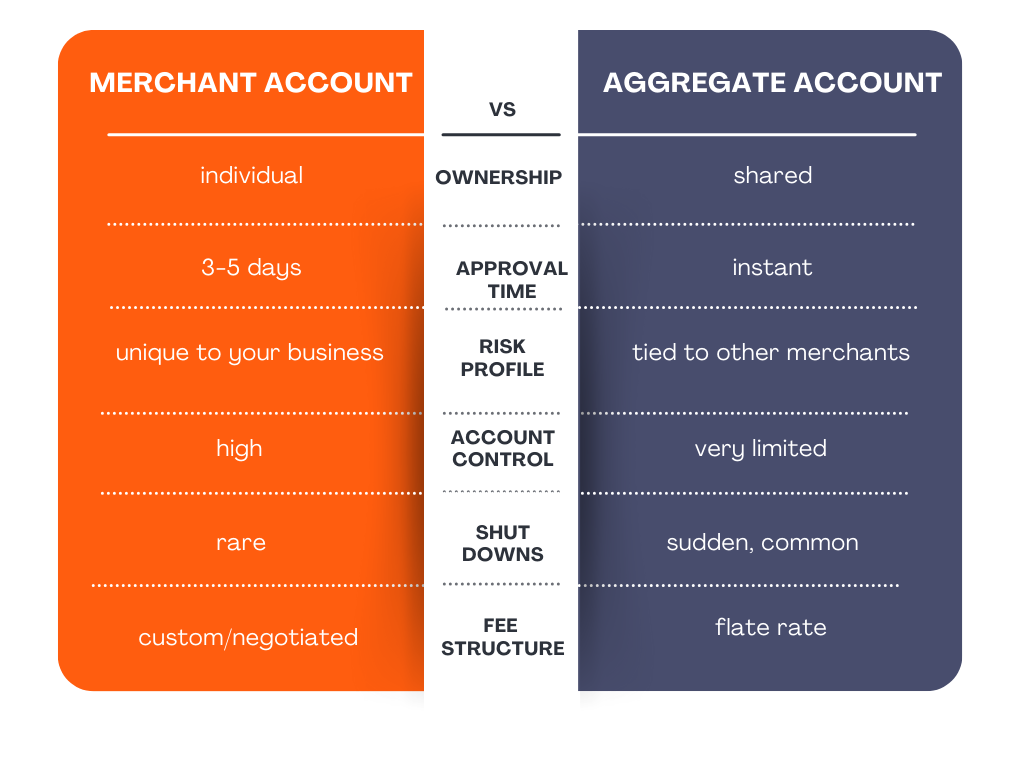

Payment aggregators like Stripe, Shopify Payments, and PayPal are not the same as merchant account providers. They aggregate transactions from thousands of businesses into a single shared merchant account — which means your business doesn’t have its own MID, and you’re exposed to the behavior of everyone else on the platform.

A dedicated merchant account gives your business its own MID, its own underwriting relationship, and significantly more stability.

For startups processing very low volume, an aggregator may be a practical starting point. But if you’re scaling, selling internationally, or operating in any regulated or higher-risk vertical, a shared MID is a structural liability. Aggregators have no obligation to give you notice before holding or terminating your account — and many merchants discover this at the worst possible time.

How to Set Up a Merchant Account: The Application Process

Setting up a merchant account involves a structured underwriting review. Here’s how to get approved and avoid the most common pitfalls.

Step 1: Gather Your Documents

Before approaching any merchant account provider, organize your business license and registration, Tax ID or EIN, recent bank statements, any existing processing statements, and a concise one-page summary of your business model and ownership. Coming prepared signals legitimacy and speeds the process considerably.

Step 2: Identify the Right Provider

Not every processor works with every business type. Identify your MCC first, then look for merchant providers who specialize in businesses like yours — considering their industry experience, approval rates, customer support, and technology stack, not just rates.

For small businesses and ecommerce merchants especially, choosing a provider with real expertise in your vertical matters more than finding the lowest headline rate.

Step 3: Compare Fees and Contract Terms

Review per-transaction fees, monthly minimums, setup fees, early termination fees, and contract length. Push for interchange-plus pricing when possible, and make sure you understand what triggers fee changes or reserve requirements.

Step 4: Submit a Complete Application

Be accurate and thorough. Discrepancies between your application and your supporting documents are the most common reason for delays or declines. Submit everything required on the first pass.

Step 5: Underwriting and KYC Review

Your provider will run Know Your Customer (KYC) checks to verify your business identity, then conduct a full underwriting review covering your credit history, projected volume, industry classification, and transaction patterns. Respond promptly to any follow-up requests — this is where most timelines either hold or slip.

Step 6: Go Live

Once approved, your provider will help configure your payment stack: terminals or POS systems, gateway integration, PCI compliance setup, and deposit schedules.

The merchants who get approved fastest are those who are transparent and prepared. Misrepresenting your business model or choosing the wrong MCC are the most common self-inflicted reasons for rejection. For a full walkthrough of what underwriters look for, see our guide on how to ensure your merchant account application is approved.

When to Switch Your Merchant Account Provider

Signs that it’s time to move to a different merchant account provider:

- Processing fees or rolling reserves are compressing your margins beyond what’s sustainable

- Your business has grown or pivoted in ways your current setup wasn’t designed for

- You’re dealing with recurring account holds, freezes, or unexplained restrictions

- You’ve been terminated by an aggregator and need a stable, dedicated solution

Switching to the right credit card merchant account processing partner can meaningfully improve approval rates, reduce costs, and eliminate the operational risk of processing on a platform that doesn’t understand your business.

For a complete reference on everything covered in this guide and more, visit the full merchant accounts resource hub.

Key Merchant Account Terminology

Issuer (Issuing Bank)

The bank that issued the card to your customer — Chase, Bank of America, Capital One, etc. The issuer approves or declines transactions, monitors fraud, and initiates chargebacks. They earn revenue from interest, annual fees, and a share of interchange on each transaction.

Acquirer (Acquiring Bank)

The bank that processes transactions on behalf of the merchant. Also called the merchant bank, the acquirer underwrites merchant accounts, accepts card transactions, and settles funds. When you apply for a merchant account, you’re establishing a relationship with an acquiring bank.

Payment Gateway

Software that securely transmits payment data between your checkout — website or POS terminal — and the acquiring bank. It encrypts cardholder data to prevent fraud. A gateway is not a merchant account; it’s the pipe that connects your checkout to the settlement infrastructure.

Interchange Fees

Transaction fees set by card networks and paid to the issuing bank on every sale. They vary by card type, transaction type, and MCC, and represent the largest non-negotiable component of merchant account fees.

Chargeback

A forced transaction reversal initiated by the cardholder through their bank. Chargebacks occur when customers dispute a charge as fraudulent, unauthorized, or unfulfilled. When filed, the funds are pulled from your merchant account — plus a chargeback fee. Sustained chargeback rates above 1% put your account at risk of termination. Clear refund policies, delivery confirmation, and detailed transaction records are your primary defenses.

Merchant Category Code (MCC)

A four-digit code assigned by card networks to classify what your business sells. Examples: 5411 (grocery stores), 5732 (electronics), 7995 (gambling). Your MCC affects interchange rates, underwriting scrutiny, and platform eligibility.

Know Your Customer (KYC)

A mandatory identity verification process that banks and processors use to confirm who owns and operates the business. Expect to provide a business license, personal identification, and financial statements.

Underwriting

The risk assessment that follows KYC. Processors evaluate credit history, sales volume projections, industry type, and transaction patterns to set account terms and processing limits. A thorough underwriting process is what separates a stable merchant account from a fragile aggregator account.

Rolling Reserve

A percentage of your processing volume held back by the acquirer as a risk buffer — typically 5–10% for 90–180 days. Common with high-risk merchant accounts. Reserves protect the processor against chargeback losses and are released on a rolling basis once your account demonstrates clean performance.