What This Article Covers

- Why “instant approval” high-risk merchant accounts are dangerous

- The Cliq FTC case and what it reveals about dishonest processors

- How to identify legitimate vs. fraudulent payment processors

- What MATCH and TMF list placement really means

- How to choose a stable, long-term payment processing partner

When your business needs payment processing, especially if you’re in a high-risk industry or have credit challenges, the promise of instant approval with rock-bottom fees can feel like a lifeline. But as the recent FTC enforcement action against Cliq demonstrates, these too-good-to-be-true offers often hide dangerous shortcuts that could destroy your business.

Key Takeaway: Legitimate high-risk merchant account providers prioritize stability and compliance over instant approval and unrealistically low fees. Shortcuts in payment processing lead to account terminations, frozen funds, and business failure.

The Cliq Case: A Warning About Payment Processor Shortcuts

What Happened to Cliq?

In January 2026, the Federal Trade Commission asked a federal court to hold Cliq, Inc. (formerly Cardflex) and its operators in contempt for systematically violating a 2015 order. The agency is seeking at least $52.9 million in relief for consumers affected by the company’s practices.

What Violations Is Cliq Alleged to Have Made?

According to the FTC, Cliq took these specific shortcuts to offer merchants attractive terms:

1. Processing for MATCH-listed merchants: They processed hundreds of millions of dollars for clients on Mastercard’s Member Alert To Control High (MATCH) list—merchants who had been terminated for violations like excessive chargebacks.

2. Helping clients evade monitoring: They actively assisted clients in avoiding bank and credit card network fraud detection programs.

3. Skipping due diligence: They failed to properly screen high-risk clients’ business practices for potential deception.

4. Ignoring red flags: They didn’t adequately monitor for deceptive practices, even when chargeback rates skyrocketed.

Why This Matters for Merchants

Payment processors who offer competitive rates and easy approval can do so because they skip over much of the work legitimate processors do. When regulatory enforcement happens, as seen with Cliq, merchants lose their payment processing ability—often with little warning and no transition period.

The Devastating Impact on Merchants

When the FTC takes enforcement action against a payment processor, the consequences for merchants are immediate and catastrophic:

Frozen funds: While the FTC investigates, ALL of Cliq’s funds are frozen. For merchants, this means:

- No payouts on recent transactions

- No access to reserve funds you’ve built up

- Money you’ve earned is completely inaccessible

- Unable to process new transactions for your business

The timeline nightmare: These investigations don’t resolve quickly. The process can take months or even years before any resolution is reached. During this entire time, your funds remain frozen while your business struggles to survive.

The final blow: If the judgment goes against Cliq and they are ordered to pay the $52.9 million in fines to the FTC, the processor may not have any funds left to pay out merchants at all. This means you effectively just lose all that money. Your reserves, your pending settlements, your hard-earned revenue: gone. This single enforcement action can crush businesses. Imagine having weeks or months of revenue, plus your entire reserve account, suddenly frozen and potentially lost forever. For many businesses, this is an extinction-level event — all because they chose a processor based on attractive rates rather than stability and compliance

Common “Too Good to Be True” Claims in High-Risk Payment Processing

Search online for “high-risk merchant account instant approval” or “high risk merchant account no reserve” and you’ll find dozens of companies making bold promises:

What Dishonest Processors Promise:

- High-risk merchant account instant approval (sometimes within hours)

- Zero reserve requirements for high-risk businesses

- Extremely low processing fees (below market rates)

- Quick MATCH list removal services

- Instant TMF list resolution

- No underwriting delays

- Guaranteed approval regardless of history

The Reality Behind These Promises:

If a payment processor can offer terms that dramatically undercut all legitimate competitors, they’re cutting corners somewhere. These corners usually involve:

- Misrepresenting your business to acquiring banks

- Skipping proper fraud monitoring

- Avoiding compliance with card network rules

- Processing through unauthorized channels

- Ignoring risk indicators that should trigger account reviews

Each of these shortcuts puts your business at serious risk of sudden account termination.

Understanding MATCH and TMF Lists: What You Need to Know

What is the MATCH List?

The MATCH list (Member Alert To Control High-risk merchants) is Mastercard’s database of merchants who have been terminated by previous processors. Common reasons for MATCH listing include:

- Excessive chargebacks

- Fraud or suspected fraud

- Money laundering concerns

- Violation of card network standards

- Business closure with outstanding balances

What is the TMF List?

The TMF (Terminated Merchant File) is Visa’s equivalent to the MATCH list. Being placed on either list significantly impacts your ability to obtain payment processing.

The Truth About MATCH and TMF List Removal

Getting payment processing WILL be more difficult if you’re on these lists. These databases exist to protect the payment ecosystem from fraudulent or high-risk merchants.

Any processor promising “instant approval” or “quick removal” from these lists is either lying or planning to misrepresent your business to acquiring banks—a practice that will ultimately harm you when discovered. Learn more about your options if you are on the MATCH List.

How Legitimate Processors Handle MATCH/TMF Listed Merchants:

Legitimate high-risk processors will:

- Be transparent about the challenges you’ll face

- Require higher reserves to offset risk (and explain why)

- Charge fees that reflect the actual risk level

- Take time to properly underwrite your account

- Not promise what they can’t ethically deliver

- Help you build a path toward eventual list removal through compliance

- Work with specialized acquiring banks that accept higher-risk merchants

Why Shortcuts Hurt Your Business

Payment processing is the lifeblood of your business. For online businesses especially, you literally cannot exist without credit card processing. When a processor cuts corners to offer you attractive terms, they’re creating a ticking time bomb:

Short-term gain, catastrophic loss: You might enjoy lower fees for a few months, but when the processor gets shut down by regulators or card networks, your processing stops immediately. No transition period. No warning. Just closed.

Account termination without recourse: When processors misrepresent your business to banks, those relationships burn. You may find yourself on the MATCH list, making future processing even harder to obtain.

Frozen funds: Processors who operate in gray areas often have their accounts frozen by regulators. Your money gets frozen too—sometimes for months or years.

Business bankruptcy: A sudden loss of payment processing capability has bankrupted countless businesses. All that work building your company can evaporate because you chose a processor based on price rather than stability.

What to Look for in a High-Risk Payment Processor

Instead of searching for “high risk payment processing instant approval” or “merchant account no reserve low fees,” focus on finding a processor built for long-term stability:

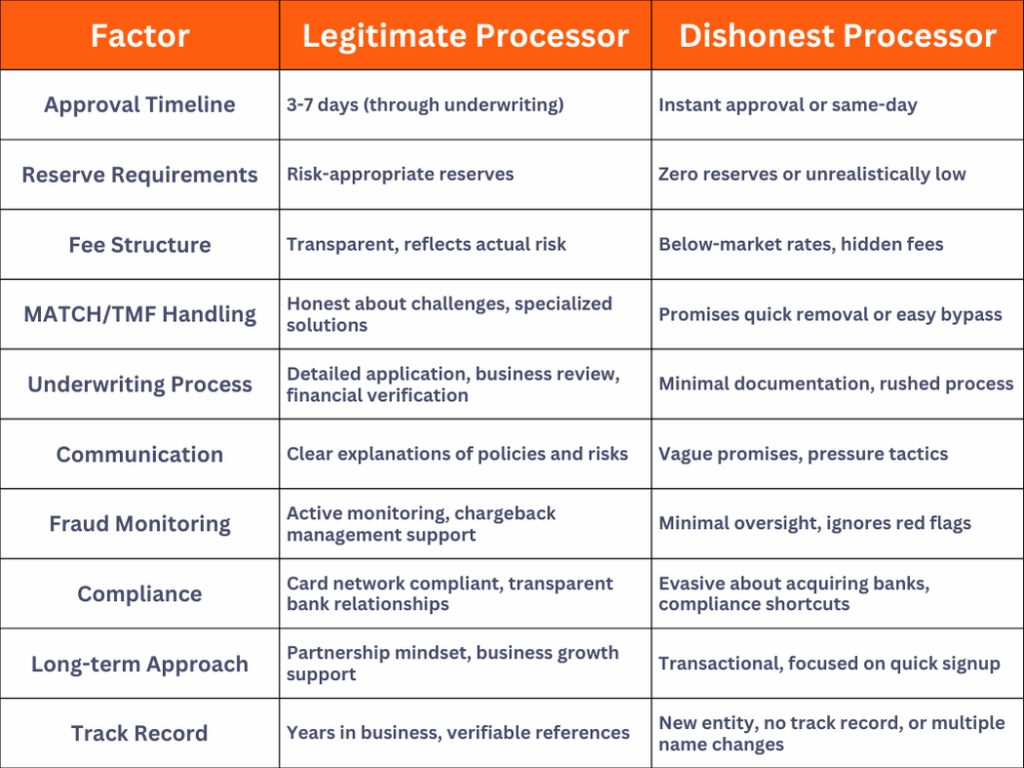

Comparison: Legitimate vs. Dishonest High-Risk Processors

1. Transparency About Challenges

Legitimate processors will be honest about the difficulties high-risk businesses face. If they’re making it sound easy, they’re not being honest.

2. Reasonable Reserve Requirements

Reserves exist to protect the processor from chargebacks and fraud. A processor offering “zero reserves” for a genuinely high-risk business is either lying about your risk level to their acquiring bank or planning to absorb losses they can’t sustain.

3. Proper Underwriting Timeline

Real underwriting takes time. “Instant approval” means shortcuts. Expect a thorough application process that examines your business model, financial history, and risk factors.

4. Established Industry Reputation

Look for processors with years of experience, industry certifications, and verifiable customer reviews. Check their standing with the Better Business Bureau and industry associations.

5. Clear Communication

Your processor should explain their fee structure, reserve policies, and risk monitoring procedures in plain English. Confusion and opacity are red flags.

6. Long-term Partnership Mindset

The best processors view you as a partner, not just a revenue source. They should offer support, guidance on reducing chargebacks, and help you build a sustainable payment processing relationship.

The Goal: Stability Over Savings

Yes, payment processing fees cut into your margins. Yes, reserves tie up your working capital. But stability in your payment processing is worth far more than saving a few basis points on your discount rate.

Ask yourself: Would you rather save 0.3% on processing fees, or ensure your business can accept payments continuously without interruption?

A processor that properly represents your business, maintains compliance with card network rules, implements appropriate fraud monitoring, and builds sustainable relationships with acquiring banks might cost more—but they’ll still be processing your payments five years from now.

Red Flags to Watch For

Be wary of any payment processor that:

- Promises instant approval for high-risk or MATCH-listed merchants

- Offers fees dramatically lower than competitors

- Claims they can quickly remove you from MATCH or TMF lists

- Rushes you through the application process

- Is vague about their underwriting requirements

- Has no verifiable track record

- Makes guarantees that sound too good to be true

Remember Christopher Mufarrige, Director of the FTC’s Bureau of Consumer Protection: “We will not hesitate to hold accountable companies that ignore red flags and distort the honest functioning of the U.S. payment system.”

When processors get held accountable, their merchants suffer too.

Building a Sustainable Payment Processing Relationship

The right approach to high-risk merchant accounts:

Be honest about your business: Misrepresenting your business model to get approved will backfire. Always.

Accept appropriate safeguards: If your business model justifies reserves or higher fees, accept them. These protect both you and your processor.

Invest in the relationship: Work with your processor to reduce chargebacks, improve fraud prevention, and build a track record of stable processing.

Prioritize stability: Choose a processor based on their ability to support your business long-term, not their ability to offer the lowest fees today.

Do your due diligence: Research processors thoroughly. Check references. Verify their claims. If something seems off, it probably is.

Frequently Asked Questions

A high-risk merchant account is a payment processing account for businesses that card networks and banks consider higher risk due to factors like industry type, chargeback history, or MATCH/TMF list placement. These accounts typically require higher reserves and fees to offset the increased risk.

Legitimate high-risk merchant accounts cannot be instantly approved. Proper underwriting requires 3-7 days to review your business model, financial history, and risk factors. Processors promising instant approval are cutting corners that will put your business at risk.

The MATCH list (Member Alert To Control High-risk merchants) is Mastercard’s database of merchants terminated by previous processors for reasons including excessive chargebacks, fraud, money laundering concerns, or violation of card network standards. Being on the MATCH list makes obtaining payment processing significantly more difficult.

In January 2026, the FTC asked a federal court to hold Cliq, Inc. in contempt for violating a 2015 order. The FTC alleged Cliq processed payments for MATCH-listed merchants, helped clients evade fraud monitoring, skipped proper due diligence, and ignored red flags. The agency is seeking at least $52.9 million in consumer relief.

Reserves protect payment processors from chargebacks and fraud losses. A processor offering zero reserves for genuinely high-risk businesses is either misrepresenting your risk level to acquiring banks or taking unsustainable risks that will lead to account termination.

Look for processors with established reputations, transparent fee structures, proper underwriting timelines (3-7 days), risk-appropriate reserves, clear communication about challenges, and a long-term partnership approach. Avoid promises of instant approval, zero reserves, or unrealistically low fees.

The Bottom Line

The payment processing industry has plenty of bad actors promising instant approvals, no reserves, and impossibly low fees for high-risk businesses. The Cliq case is just one example of how these companies operate—and how they eventually get shut down, taking their merchants’ businesses with them.

When something seems too good to be true in payment processing, it usually is. The processors cutting corners to offer attractive terms aren’t doing you a favor—they’re building your business on a foundation of sand.

Find a payment processor with a reputation for honesty and compliance. Build a relationship that’s mutually beneficial. Accept that high-risk processing costs more because it legitimately carries more risk.

Your payment processing is too important to gamble on. Choose stability over savings, transparency over promises, and long-term partnerships over short-term deals.

Your business—and your ability to keep processing payments—depends on it.

Looking for legitimate high-risk payment processing? Skip the “instant approval” promises and focus on processors with established reputations, transparent practices, and sustainable business models. Your future self will thank you.