- MERCHANT ACCOUNTS

- Merchant Category Code

- PAYMENT GATEWAY

- PAYMENT PROCESSING

- USA MERCHANT

- USA MERCHANT ACCOUNT

One Account, Two Businesses? Exploring Business Bank Accounts, Merchant Accounts, and LLCs

Jul 19, 2023 3 minutes

If you’re anything like me, you’re continually looking for ways to streamline your operations and optimize your business financials. One question that seems to pop up frequently is, “Can I use the same bank account for two businesses?”

And it’s no wonder this query surfaces so often. After all, wouldn’t it be simpler to handle all the transactions from one central hub?

As an experienced merchant account provider and an entrepreneur myself, I’ve navigated these waters more than once. I’ve seen firsthand the enticement to simplify financial management and the potential complications that can come along with it.

Whether you’re considering using the same merchant account, payment gateway, or even the same LLC for multiple businesses, it’s crucial to arm yourself with the right information before you dive in.

The Basics: Understanding the Terms

Before we delve into the meat of our topic, it’s essential we’re all on the same page regarding the key terms we’ll be discussing. So, what exactly is a merchant account, a payment gateway, and an LLC?

- Business Bank Account: A business bank account is a type of account specifically designed for businesses, rather than individuals. Unlike a personal bank account, a business bank account can handle higher volumes of transactions and cash deposits. Additionally, these accounts come with features that cater to business needs, such as payroll services, the ability to accept credit and debit card payments, business credit cards, and more. A business savings account also offers far more relative benefits than that of a personal savings account, like higher interest rates.

- Merchant Account: This is a type of bank account that allows businesses to accept payments in multiple ways, primarily credit cards. Think of it as your business’s financial bridge between your customer’s payment and your business bank account. The funds are first transferred to the merchant account and then eventually end up in your business’s bank account. You need a business checking account before opening a merchant account.

- Payment Gateway: This is a technology that captures and transfers payment data from the customer to the merchant. If you’ve ever bought something online, you’ve used a payment gateway. It’s like an online point of sale terminal for your website. It’s the technology that encrypts sensitive credit card details to ensure data passes securely between the customer and the merchant, and from the merchant to the payment processor.

- LLC (Limited Liability Company): An LLC is a specific form of a private limited company in the United States. It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation. Basically, this means that, as an owner, you’re not personally liable for the company’s debts or liabilities.

These are the three concepts we need to understand in order to successfully run multiple businesses and streamline finances.

Need help with your merchant account, bank account, or gateway? Let us know!

Can You Use the Same Business Account for Two Businesses?

In the realm of business, efficiency and convenience often take center stage – particularly when it comes to managing finances. So, it’s natural to wonder, “Can I use the same bank account for two businesses?”

Technically, it’s possible, but it’s usually not the best idea. Keeping a separate business bank account for each business is recommended for a few important reasons.

Firstly, separate accounts make it much easier to keep track of each business’s income, cash flow, and business expenses. This clarity is crucial when it comes time to file taxes or if you’re ever audited by the IRS.

Secondly, separate bank accounts can protect each business from the other’s potential financial problems. If one business goes into debt or faces legal issues, a shared bank account could put the other business’s funds at risk which won’t be covered by FDIC insurance (Federal Deposit Insurance Corporation).

If one business gets frozen, you won’t have access to any funds or banking services for any of your businesses if they all use the same account. That means you can’t transfer funds or make withdrawals to even pay for business operations.

Finally, maintaining different accounts for each business helps create a clear financial identity for each one. This can be especially important if you ever plan to sell one of your businesses, as clear financial records can make a business more attractive to potential buyers.

However, you can use the same one if your businesses operate under the same umbrella company. It could help you avoid getting a business loan or struggle to meet the minimum balance requirements for the new business. But you should aim to use multiple bank accounts as soon as you can.

Overall, using the same bank account for multiple businesses might seem like an easy way to simplify your finances, but in reality, it could complicate things more. For the sake of clarity, protection, and future flexibility, it’s usually better to use different bank accounts for each business.

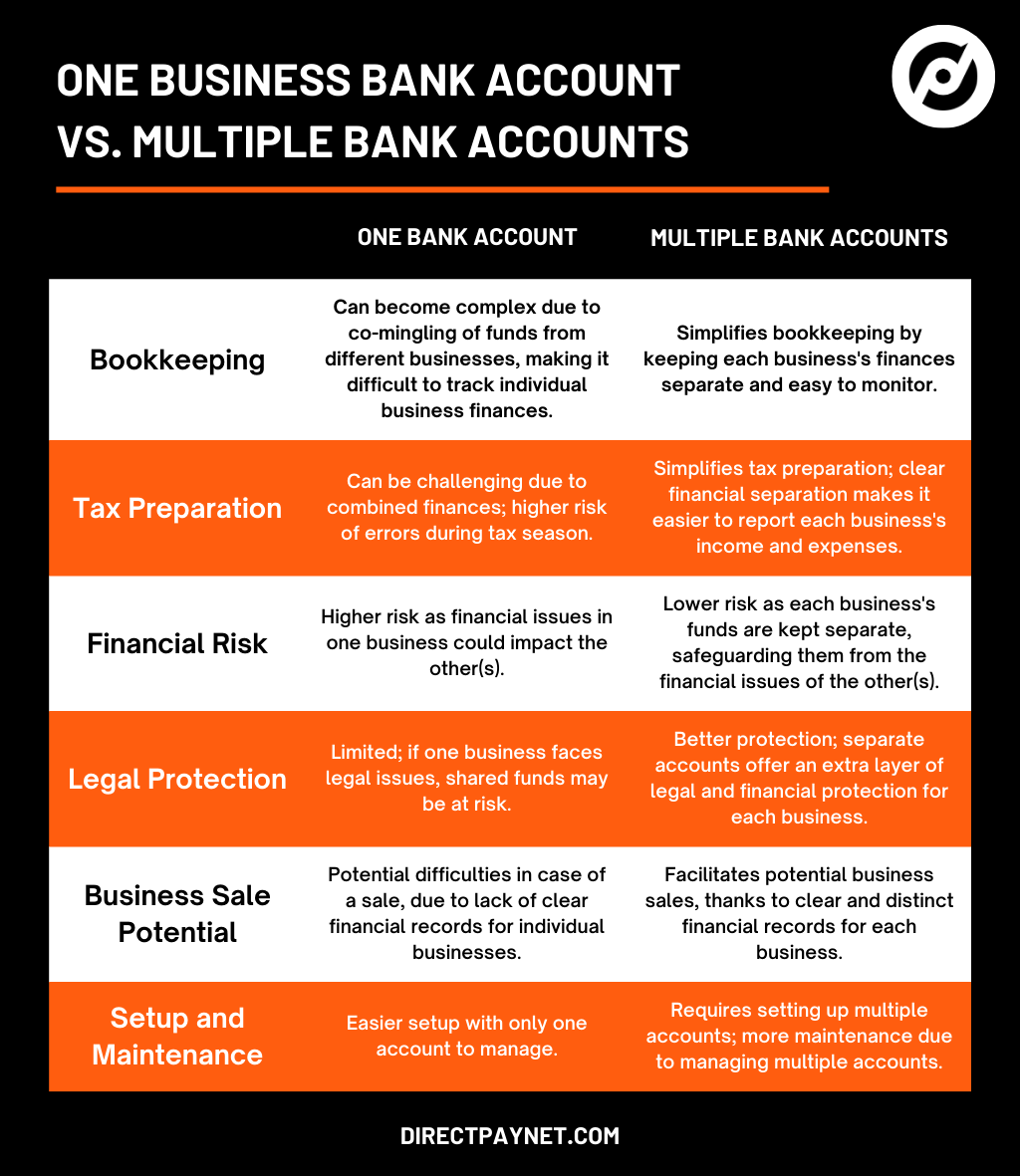

One Business Bank Account versus Multiple Business Bank Accounts

Can You Use the Same Merchant Account for Multiple Businesses?

You’ve got two businesses, you’re comfortable with your merchant account provider, and you’re thinking, “Can I simply use the same merchant account for both businesses?”

Well, this is where we step into a bit of a gray area. Technically, yes, it is possible to use the same merchant account for different small businesses. However, is it advisable? That answer tends to lean towards no.

The appeal is understandable. You’re familiar with the interface, you appreciate the customer service, and most of all, you appreciate the simplicity of managing everything from one account. Yet, as attractive as it might seem, it’s not typically the best approach, primarily due to the risk of ‘co-mingling’ funds and the potential for confusing bookkeeping.

Co-mingling, or mixing your funds, can create accounting nightmares, especially at tax time. It makes it more challenging to track which revenues and expenses belong to which business. Additionally, it could complicate matters in the event of a financial audit and result in a legal nightmare for your businesses.

Another issue is the handling of chargebacks. If you’re using the same merchant account for two businesses and one of them experiences a chargeback, it could impact the other’s operation. In essence, business A’s issue could unfairly affect business B.

And then there’s the consideration of business reputations. Merchant services often use the Merchant Category Code (MCC) to classify the type of business processing the transaction. If you’re operating vastly different businesses from the same merchant account, this does not look good to your provider and you could be charged with fraud.

That said, there are situations where using one merchant account could make sense, such as when your businesses are closely related in the products or services they offer and share similar operational and financial practices. But it’s better to use different accounts to keep things clear and legal. When you open a merchant account, you are assigned a MID, which is VERY difficult to use across multiple businesses…unless they all run under the same LLC.

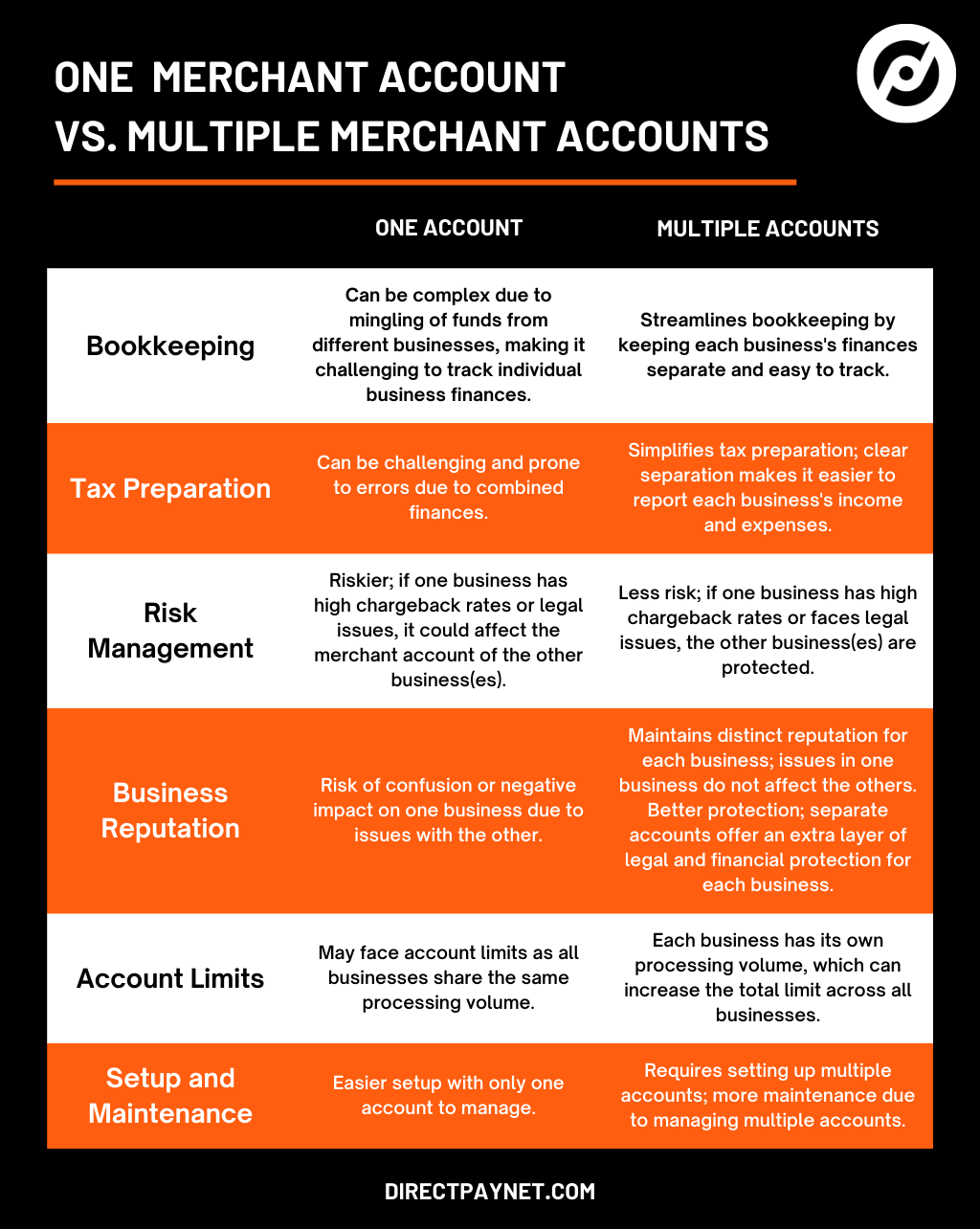

One Merchant Account versus Multiple Merchant Accounts

Can You Use the Same Payment Gateway for Multiple Stores?

If you’re operating multiple online stores, you might wonder if it’s possible or even recommended to use the same payment gateway for all of them. The answer, generally, is a resounding yes!

Unlike merchant accounts, where we suggested maintaining separate ones for different businesses, using the same payment gateway across multiple online stores can actually streamline your operations.

A payment gateway, the trusty courier of customer payment data, isn’t tied to your business’s specific financial details in the same way a merchant account is. Instead, it serves as a tool to securely accept, encrypt, and transmit payment information.

Using the same payment gateway for several stores could potentially reduce the time you spend learning different platforms and simplify your transactions.

In fact, many payment gateways are designed with multi-store management in mind. They allow you to add multiple stores under one account, with each store having its own settings and preferences. This feature means that all your startups can have a uniform checkout experience, a feature that can help build and maintain customer trust.

However, keep in mind that while using the same payment gateway for all your stores simplifies things for you as a small business owner, it doesn’t inherently simplify your bookkeeping. You’ll still need to keep track of which transactions correspond to which businesses. Some payment gateways provide features that help with this, so it’s worth spending time exploring your options.

If you’re not an organized person or don’t have someone handling the books, then using the same payment gateway for multiple stores is probably not a good idea.

Another factor to consider is transaction fees. If you’re running multiple stores with significant volumes of transactions, you may be able to negotiate lower transaction fees with your payment gateway provider.

Lastly, remember that customer experience is paramount. If you operate in different regions with different preferred payment methods, you should ensure your payment gateway supports these methods. The same goes for currencies; if you sell internationally, you’ll want a gateway that can handle multiple currencies.

Something else to think about: using multiple payment gateways for one store. Some gateways offer better features than others and might appeal to certain segments of your audience.

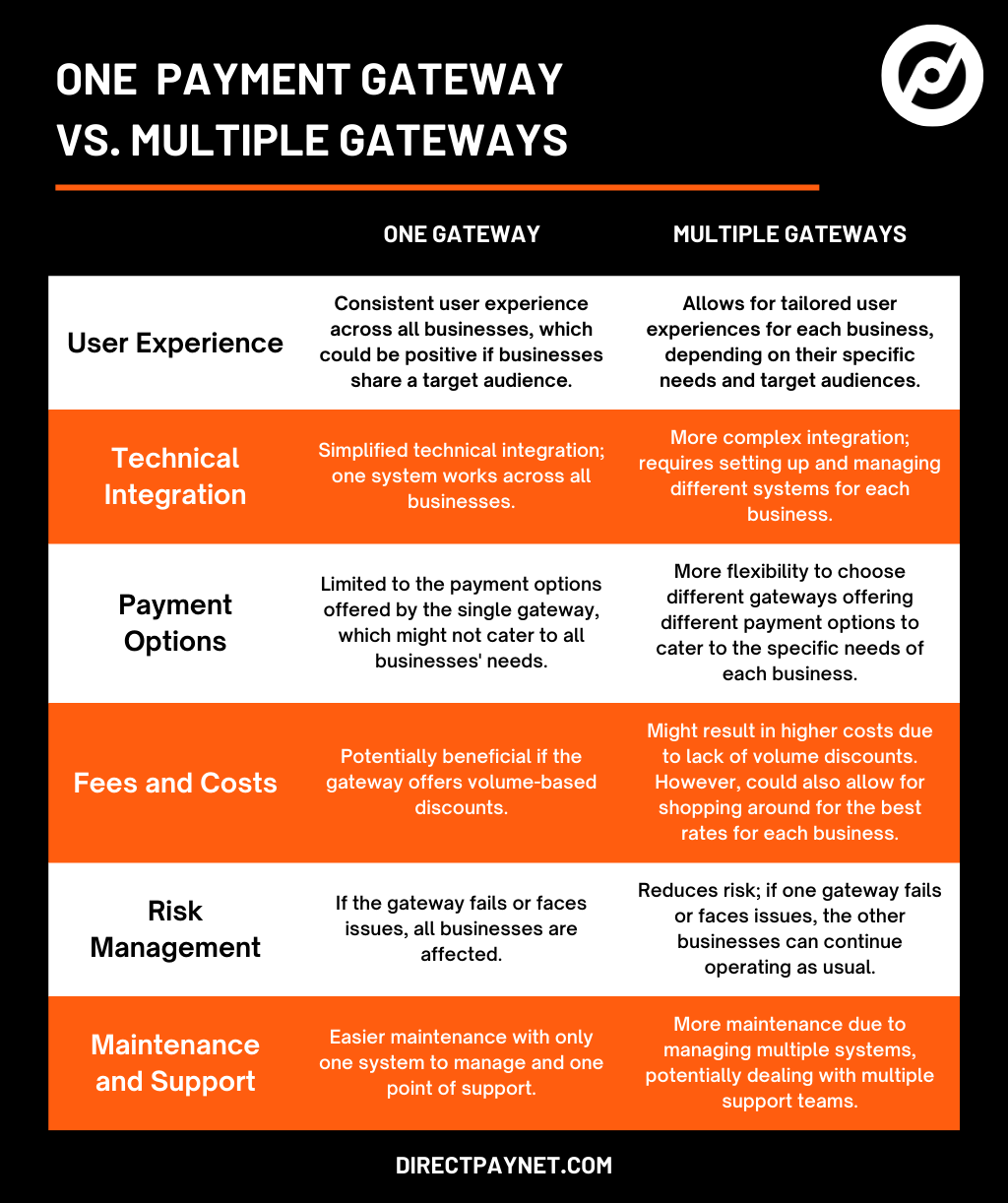

One Payment Gateway versus Multiple Payment Gateways

Can You Use the Same LLC for Multiple Businesses?

Taking on the challenge of running multiple businesses prompts another important question: “Can I operate these businesses under the same LLC?” The answer is yes, you can, but as with our earlier discussions, it’s crucial to understand the potential perks and drawbacks before proceeding.

Operating multiple businesses under one LLC can offer several advantages.

For starters, it’s simpler. With one LLC, you’re only required to file one set of tax returns, reducing paperwork and possibly accounting expenses. Also, forming an LLC can be costly depending on your state, so having a single LLC for multiple businesses can save on these initial setup costs.

It’s easy to add a business under an established LLC. All you have to do to register the new business is add into the LCC “[LLC Business Name] is doing business as [New Business Name]”. It’s a simple DBA clause that covers your new business without the headache of opening a new LCC or incorporating in another way.

However, it’s not all sunshine and roses. One major concern is liability. Remember, LLC stands for Limited Liability Company, which means the owners are not personally liable for the company’s debts or liabilities. However, if you operate multiple businesses under one LLC and one business gets sued or incurs debt, all businesses under that LLC are exposed to that liability.

Essentially, a problem in one business could threaten the others, even if they are entirely unrelated.

Another downside to operating multiple businesses under one LLC is the potential for confusion among customers and clients. If your businesses are in very different industries or target very different clientele, operating them under the same LLC might cause brand confusion.

So, what’s the solution? One common approach is to form an LLC for each individual business, effectively separating the liabilities and financial obligations of each. If one business fails or faces legal issues, the others are shielded from the fallout.

Another option is to create a series LLC, available in certain states. A series LLC allows you to form an “umbrella” LLC under which you can operate multiple separate entities, or “series”. Each series operates as a separate unit with its own members, assets, and operations, and is shielded from the liabilities of the other series.

Start Your Multi-Business Approach with the Right Merchant Account(s)

Running multiple businesses is no small feat. It requires juggling various elements of operations, marketing, and perhaps most importantly, financial management. When dealing with components like merchant accounts, payment gateways, and LLC structures, the decisions you make can significantly impact your businesses’ efficiency, financial health, and overall success.

As we’ve discussed, using the same merchant account, payment gateway, or LLC for multiple businesses isn’t a black or white issue. It depends on several factors, including the nature of your businesses, your financial management preferences, and your growth plans.

But one thing remains clear: making informed decisions is crucial, and that’s where we come in. At DirectPayNet, we have years of experience in helping business owners navigate the complexities of merchant accounts, particularly in high-risk industries. We’re here to provide tailored solutions that meet your business needs and ensure your businesses can accept payments safely and efficiently.

If you’re ready to take the next step in optimizing your financial operations across multiple businesses, consider opening a high-risk merchant account with DirectPayNet. Let our team guide you through the process, provide expert advice, and equip you with the tools to manage your business finances effectively.